For Institutional / Professional Use Only

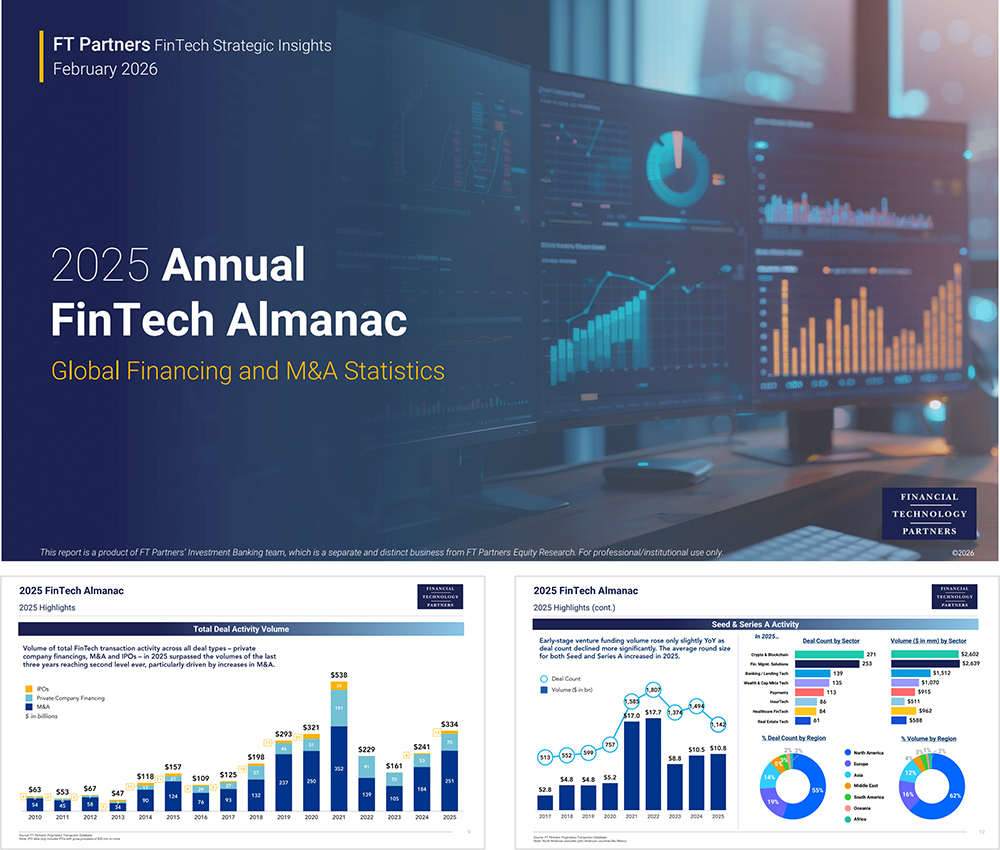

FT Partners Publishes 2025 FinTech Almanac– Total Deal Activity Volume Hit Second Highest Level Ever

Another year is in the books, and 2025 was a stand-out chapter in FinTech's storied history. Deal making momentum, renewed large-scale capital raising efforts and a long-awaited return of IPOs globally, all propelled 2025 total deal activity volume to the second highest level ever, only behind 2021. Despite several notable IPOs, many FinTech heavyweights remain private, climbing – or jumping – to new valuation highs during the year (Revolut $75 billion, Ripple $40 billion, Ramp $32 billion, among others). Mega funding rounds returned, with companies like Binance, Trade Republic, Polymarket, and Kalshi all closing $1 billion+ primary and secondary deals. And last but not least, the wave of FinTech M&A that many have anticipated for years, surged in 2025 with the highest number of FinTech M&A transactions ever.

Report features:

- 2025 and historical FinTech financing, IPO and M&A volume and deal count statistics

- Largest FinTech financings and M&A transactions in 2025

- Most active FinTech investors including strategic investor participation

- Breakdowns by geography and deal type

- FinTech sector and sub-sector highlights

FT Partners Publishes New In-Depth Report on Commodities FinTech

Commodities producers face many industry-specific challenges, including: manual and archaic processes; a wide variety of outputs and related contracts; large, unstructured datasets; and unique pricing dynamics whereby pricing power is minimal, making revenue streams potentially highly volatile. This presents a major opportunity for FinTech and technology solutions to automate workflows and improve risk management, long-term visibility and forecasting, and overall efficiency. A number of vertical-specific solutions have emerged in recent years, aiming to streamline Office of the CFO functions specifically tailored for commodities producers.

Key discussion topics of the report include:

- A discussion of the vertical-specific challenges faced by commodities producers, particularly on the more volatile revenue side of the P&L

- An overview of the various FinTech solutions that have emerged to help solve these issues across the commodities sector globally

- Profiles of 20+ leading FinTech companies serving commodity producers and the broader commodity value chain

- Exclusive interviews with the CEOs of leading companies in the space

Watch the Replay – Tokenization of Real World Assets: The State of Play – VIP Video Panel

On December 16, 2025, FT Partners hosted a VIP video conference, Tokenization of Real World Assets: The State of Play, that brought together leaders of five highly influential companies across financial markets, trading and digital assets. Tokenization of RWAs is gaining strong momentum as the new revenue opportunities and operational efficiencies that blockchain technology introduces are clear. A number of players are building in this space, but there will be winners and losers. Panelists discussed the current state of the tokenization market, what is gaining traction, what dominoes are starting to fall that will lead to widespread adoption, and what the world of on-chain capital markets looks like in the years ahead.

Our panelists include:

- Yuval Rooz, Co-Founder & CEO of Digital Asset

- Billy Hult, CEO of Tradeweb

- Adena Friedman, Chair & CEO of Nasdaq

- Mike Cagney, Co-Founder & Executive Chairman of Figure

- Don Wilson, Founder & CEO of DRW

VIP Video Conferences

Tokenization of Real World Assets: The State of Play

On December 16, 2025, FT Partners hosted a VIP video conference, Tokenization of Real World Assets: The State of Play, that brought together leaders of five highly influential companies across financial markets, trading and digital assets. Tokenization of RWAs is gaining strong momentum as the new revenue opportunities and operational efficiencies that blockchain technology introduces are clear. A number of players are building in this space, but there will be winners and losers. Panelists discussed the current state of the tokenization market, what is gaining traction, what dominoes are starting to fall that will lead to widespread adoption, and what the world of on-chain capital markets looks like in the years ahead.

Building & Securing the Global Blockchain Economy

On August 14, 2025, FT Partners hosted a VIP video panel on building and securing the global blockchain economy. The panel brought together leaders of five highly influential companies in the blockchain and crypto space and covered key innovations, developments around institutional adoption, and best practices that will be critical as the world adopts blockchain and the global economy moves onchain.

Women in FinTech 2025

On March 27, 2025, FT Partners hosted our fifth annual VIP video conference featuring leading women in FinTech! The panelists shared inspiring stories from their career journeys, their views on the impacts of AI across financial services and offered advice on fundraising, hiring and more for aspiring entrepreneurs and future leaders in FinTech.

FT Partners’ FinTech Strategic Insights

FT Partners regularly publishes in-depth strategic insights highlighting key trends driving market activity across the FinTech Landscape. Our proprietary FinTech insights, data and analysis has been featured on Bloomberg, the Wall Street Journal, Dow Jones and the Financial Times and is regularly viewed by CEOs and industry leaders. FT Partners' unique insight into FinTech is a direct result of successfully executing hundreds of transactions combined with over 20 years of exclusive focus on the FinTech sector. Follow FT Partners on Twitter and LinkedIn for real time updates, and subscribe to FT Partners' Monthly FinTech Market Analysis for the industry's most comprehensive and detailed updates on the FinTech sector.

Each report published by FT Partners contains an in-depth review of a unique area of the FinTech marketplace and is highly valuable and topical to CEOs, board members, investors and key stakeholders across the FinTech landscape. Each report is continually updated by the FT Partners Strategic Insights Team with the latest information, facts and metrics to provide our readers with the most up-to-date and comprehensive subject matter. The latest version of each report is provided below along with a brief overview of the report contents.

For institutional / professional use only.

CEO Monthly Market Update & Analysis Reports

FT Partners provides the broadest and most specialized coverage of FinTech with our comprehensive monthly sector-specific reports. Our depth of research and insight is unmatched in the industry and these reports are widely recognized and reviewed by top CEO's and investors in the market. Each monthly report includes sector-specific public company comparables, recent financing and M&A transactions and upcoming industry conferences and events. The latest month’s reports are available below. Subscribe to receive the latest reports every month.

February 2026

Exclusive Executive Interviews

Daniel Price & David Klemm

Co-Founders

WeatherPromise offers weather guarantees that reimburse customers when specific adverse weather conditions impact planned events, travel, or outdoor activities.

Daniel Kalish

Co-Founder & CEO

Nilus is the first agentic system of action for treasury, designed with the goal of bridging the gap between static bank data and financial action, harmonizing fragmented streams from banks, ERPs, and PSPs into a single unified financial data layer.

Hanna Wu

Founder & CEO

Amplify is a digital life insurance platform that lets customers invest their premiums in public equities and high-yield accounts, building tax-efficient wealth while securing lifelong protection.

Recent Transaction Profiles

FT Partners frequently publishes detailed profiles on significant financing, IPO, and M&A transactions in the FinTech space. See below for a selection of our latest reports.

Acquires

Charles Schwab Agrees to Acquire

Forge (NYSE: FRGE) for $660 million

$75,000,000

Model ML Raises $75 million

in Series A Financing

$923,000,000

Navan (Nasdaq: NAVN) Completes its IPO

Raising $923 million

Quarterly Insights & Annual Almanacs

Comprehensive FinTech Financing, M&A and IPO data

FT Partners’ FinTech Insights Reports are published on a quarterly basis, along with a comprehensive year-end FinTech Almanac. All information included in the reports is sourced from FT Partners’ Proprietary Transaction Database, which is compiled by the FT Partners Strategic Insights Team through primary research and data analysis. The reports feature M&A, financing and IPO statistics and trends as well as breakdowns by FinTech vertical, geography, investor-type and much more. Be sure to check back for quarterly updates and additions. All recent reports can be viewed or downloaded for free.

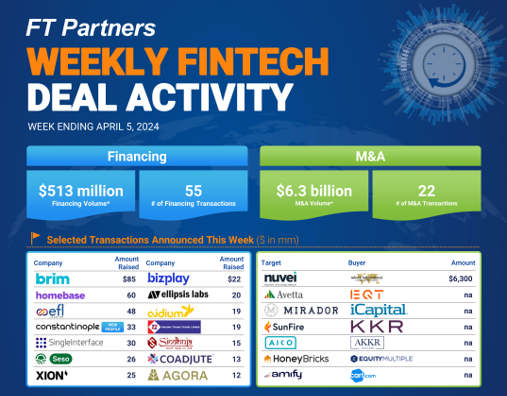

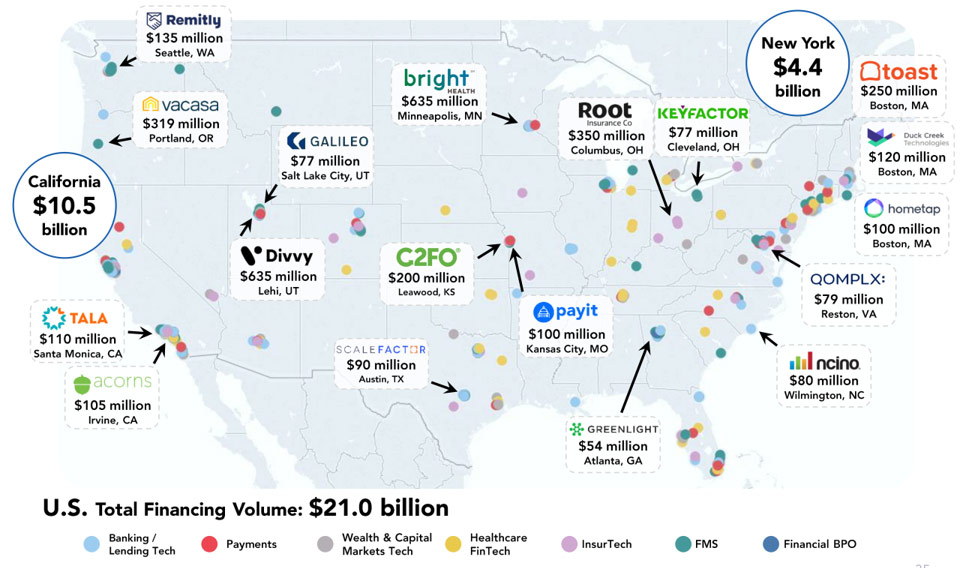

Regularly Updated Infographics

FT Partners regularly publishes infographics highlighting global FinTech transaction activity covering financings, IPOs, SPACs and M&A deals. This deal activity is derived from our proprietary transaction database. Available infographics include:

Weekly FinTech Deal Activity

- Features total financing / M&A dollar volume and deal count

- Highlights largest transactions in the week

- Tracks YTD activity by FinTech Sector and Geography

Monthly FinTech Deal Activity

- Summarizes month-end financing and M&A deal activity

- Breaks down monthly activity by FinTech Sector and deal size

- Highlights largest transactions in the month

- European infographic tracks financing activity by country

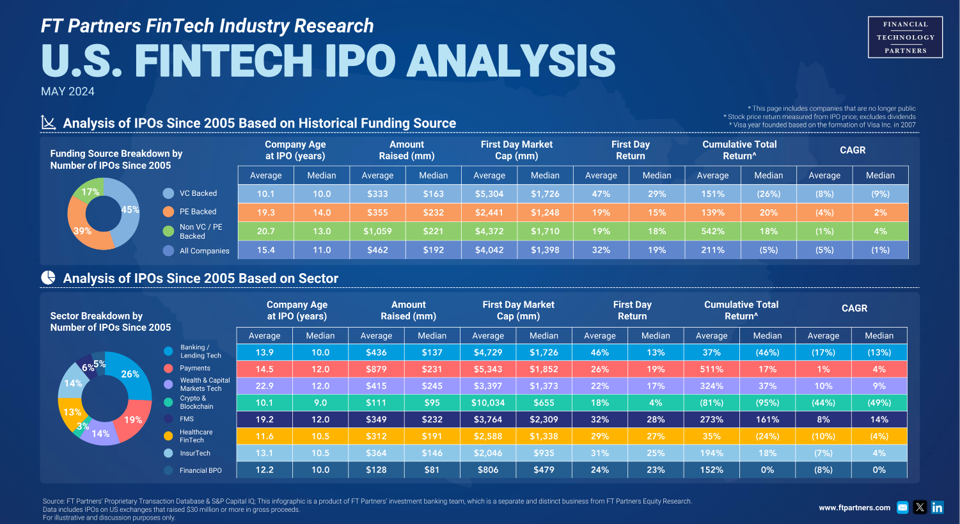

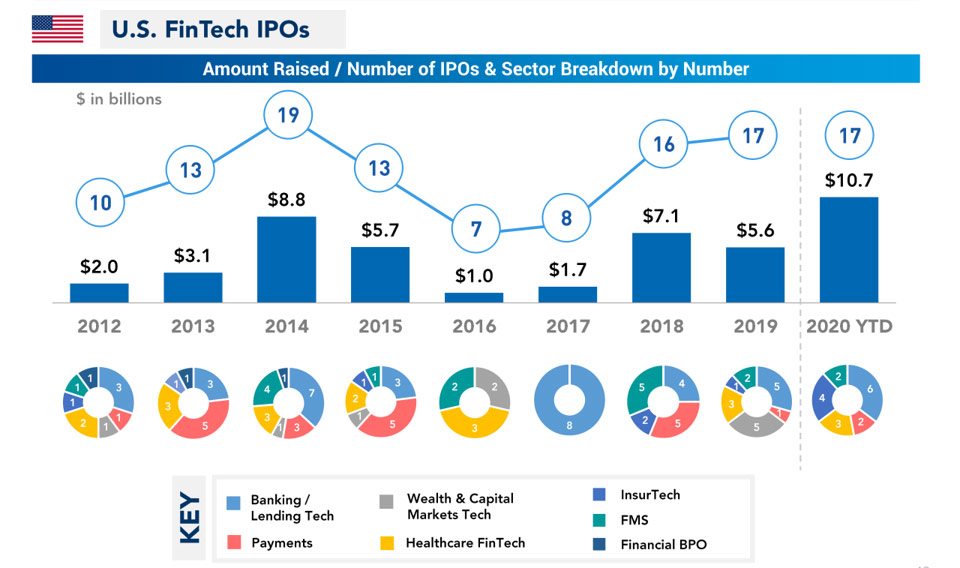

U.S. FinTech IPO Analysis

- In-depth analysis of U.S. FinTech IPOs over the past decade including yearly breakdowns by capital raised and FinTech sector

- Rankings of the largest IPOs by capital raised, best and worst performing and most recent FinTech IPO transactions

- Insight into pending IPOs, spin-offs and companies acquired while on file for an IPO

- Details on the most active investors in FinTech IPOs

- Ranking of the most well funded private FinTech companies

Selected Reports

Commodities FinTech: How Technology is Reshaping Risk, Revenue and P&L Management for Commodity Producers

Commodities producers face many industry-specific challenges, including: manual and archaic processes; a wide variety of outputs and related contracts; large, unstructured datasets; and unique pricing dynamics whereby pricing power is minimal, making revenue streams potentially highly volatile. This presents a major opportunity for FinTech and technology solutions to automate workflows and improve risk management, long-term visibility and forecasting, and overall efficiency. A number of vertical-specific solutions have emerged in recent years, aiming to streamline Office of the CFO functions specifically tailored for commodities producers.

Restaurant Tech: A Strong Technology Backbone is Becoming Table Stakes

Although the masks have faded, the COVID-19 pandemic left an indelible mark on the restaurant industry. The post-COVID impact was felt across all facets of the industry including reservations, takeout and delivery, staffing, input pricing, marketing, and payments. While consumers have long since returned to in-person dining, demand for off-premise interactions and omni-channel experiences has not dissipated given the degree of convenience they provide. To solve these challenges, restaurants have turned to technology solutions in greater ways than ever before. In fact, a strong technology backbone has become table stakes across the industry. Fortunately, FinTech and other technology providers are rising to the occasion with tailored solutions that simplify complexity, streamline operations, reduce operating costs, and create a more seamless customer experience. A wide range of AI-driven solutions have also emerged to help operators automate a wider range of processes, improve efficiency and boost margins.

Stablecoin Payments: Crypto Finds its Killer App?

Stablecoins have received significant attention in recent months, particularly since Stripe's $1.1 billion acquisition of stablecoin player Bridge, along with several noteworthy product launches signaling new entrants into the stablecoin ecosystem. Clearly, momentum is building in the stablecoin market. Crypto skeptics have historically pointed to the lack of a "killer use case" as the primary basis for their skepticism. However, with stablecoin adoption growing in cross-border payments, from peer-to-peer remittances to B2B payments, as well as treasury management, it appears that the killer use case has finally arrived.

Women in FinTech: A New Era of Innovation

Artificial intelligence as well as Crypto / Blockchain technologies both have the potential for wide-scale advancements in the way consumers and businesses interact with the financial world, while also upending the bedrock of our financial institutions. With such great power of change, diversity of thought in our industry is not a nice-to-have, but a necessity. For this report, we interviewed a select group of female leaders and change-makers that are ushering in a new era of FinTech innovation through their work surrounding AI and Crypto / Blockchain technologies. We asked this group about the benefits and opportunities these technologies pose for the financial services industry as well as the risks and challenges that still exist and lie ahead. Further, they share guidance on leadership in the tech and startup world, stories from their career journeys and offer actionable advice for empowering more women to jump head-first into this new era of FinTech.

FinTech Sets its Sights on 2025

After a few challenging years, FinTech appears to be on the upswing again, with deal activity and stock prices having largely rebounded. Over the past few years the market recalibrated amid shifting macroeconomic realities and investor expectations. While performance metrics and business models were reevaluated, entrepreneurs' visions and the global need for FinTech never wavered. Now, the data paints a picture of steady early-stage investment activity, a modest return of late-stage fundraising, a definitive swell of M&A activity, and an IPO market poised for action, as a number of trends and innovations continue to drive the industry forward. From AI agents to stablecoins, payment orchestration, and cross-border e-commerce, this report discusses key trends to watch in 2025.

Unlocking Data in the Digital Asset Ecosystem

Institutional investors often require more complex types of data to leverage in trading strategies and manage compliance. In traditional capital markets, much of this data already exists and is standardized across large vendors or by regulatory bodies. In the digital asset market, however, the data lacks standardization from data definitions to delivery technologies, and beyond; further, the quality and scope of data is often inconsistent, varying widely from vendor to vendor in a way that is not present in traditional capital markets. A number of FinTech companies have launched innovative data-driven solutions for the digital assets market, but the market still has significant room for growth.

Parking Payments & Curb Management: A Large Auto FinTech Opportunity

City streets and curbs have never been more difficult to manage. Technological advances and changing consumer preferences have caused complex curb management challenges for cities as they attempt to adopt more innovative technology solutions on the path toward becoming more efficient, safer, and more citizen-friendly places to live. Curb management solutions – which include street and garage parking, payments, permitting, compliance, and more – have largely been disparate and siloed historically, which is no longer viable due to the increasing complexity and technological advances in the space. This has led to the emergence of new products and innovative companies aiming to solve these pain points for cities in a unified, streamlined manner, making curb management one of the largest Auto FinTech opportunities globally.

FinTech in Africa: A Thriving Opportunity

Africa's FinTech ecosystem has continued to flourish despite macro headwinds, as business models have proven to be investable, large financing rounds continue to take place, exits are increasing in frequency, and many large global investors and strategics have taken notice. As global best practices have taken hold in Africa, key risks of investing in the region have declined, and the result has been a boom in FinTech funding over the past three years. While volumes have declined from 2021's record levels, 2023 financing volume of $1.2 billion was still nearly 3x the levels seen in 2019.

Women in FinTech: Perseverance & Resilience

Perseverance has been an essential tool for the progress of women’s rights and empowerment globally, helping to break barriers and effect change across social, political and economic arenas. Perseverance and resiliency are also vital characteristics of successful entrepreneurs and corporate leaders. For this report, we assembled a collection of 25 exclusive interviews featuring leading female founders, CEOs, executives and investors in the FinTech industry to gain insight into how perseverance has played a role in their career journeys, how they have navigated challenging market dynamics of late, and what work still needs to be done to empower women and further diversity in our industry.

Company Overview: Bilt – A Rewards Network Centered On the Home & Neighborhood

Following Bilt's announcement of its FT Partners-advised $200 million financing round at a $3.1 billion valuation (with Ken Chenault, former CEO of American Express, joining the board), the Company's writeup in Bloomberg, and the virtual fireside chat we hosted with CEO Ankur Jain on January 31, there has been a dramatic increase in interest in Bilt's business model. Given the large volume of inbounds, we worked with Bilt to take a deeper look at the Company's mission and business model, and its innovative approach to integrating the home and neighborhood into a comprehensive rewards network. While we don't share exact figures and unit economics, this profile should give readers a comprehensive look at the uniqueness of Bilt's network model, which has propelled the Company to $200 million in annualized revenue and profitability since its public launch in just March of 2022.

The FinTech Journey Continues: What to Watch for in 2024

2023 through all its ups and downs – from bank crashes to an S&P 500 record high – was a year of re-balancing for the FinTech sector. Lofty valuations were re-thought and "mega" deals were intermittent as founders and investors worked off the excesses of recent years and re-evaluated business models and goals. Still, with a strong flow of early-stage funding activity, alongside continued successes from established players, the FinTech sector's journey continues as companies reimagine and reinvent financial services. Despite the challenges in the overall market, numerous FinTech innovations are thriving across various market segments and regions around the world. In this report, we discuss several key themes we expect to impact the FinTech ecosystem in 2024, from generative AI to real-time payments, to the rapid acceleration of FinTech across emerging markets.

US Spot ETF Approval a Shot of Adrenaline for Digital Assets Market

On January 10, 2024, the SEC finally approved a U.S-listed spot bitcoin ETF – a watershed moment for the digital asset industry. The SEC’s long-awaited move brought significant renewed attention to the cryptocurrency and digital asset space, and the entry of asset management giants like Fidelity, Blackrock, and Franklin Templeton will surely help shine a bright spotlight on the space. The combination of strong consumer interest and widening institutional adoption of crypto-related products presents a huge opportunity for the digital asset space.

The report features:

- Discussion of the recent SEC approval of spot bitcoin ETFs

- Crypto market data

- Exclusive interview with Marcel Sampaio, Co-Founder & CEO of Hashdex

FinTech in India: A Digital Gold Rush

With one of the fastest-growing economies in the world, a young, tech-savvy population, and a large contingent of citizens who are underserved by traditional financial services, India has rapidly emerged as a FinTech powerhouse. As a result of these favorable trends, in addition to a high concentration of tech talent and a number of government initiatives aimed at driving financial inclusion, India's burgeoning FinTech sector has attracted billions from global investors in recent years. In 2022, Indian FinTech companies raised nearly $6 billion, the third most of any country behind only the US and UK, accounting for around 7% of all FinTech financing volume globally.

Innovations in Payroll and Human Capital Management

The global payroll industry is undergoing a seismic shift, driven by the rise of distributed work, an increasing number of self-employed and freelance workers, as well as technological innovations that have made domestic and global payroll more efficient, flexible, and compliant in order to meet evolving market demands. In recent years, FinTech companies have launched new payroll and adjacent innovations including cloud-based, multi-country payroll systems, global Employer of Record solutions, earned wage access (EWA), payroll data platforms, payroll lending services, and more. FinTech innovators are clearly waking up to the strategic value of payroll processing, as the path to providing many workforce solutions leads through payroll.

Women in FinTech: Rising Stars

For the Rising Stars report, FT Partners asked the FinTech ecosystem to nominate women that are leading the way for the future of FinTech, across all departments and roles, from product management, marketing, technology, finance, investing, entrepreneurship and leadership. We witnessed a positive outpouring from all sides of the industry resulting in hundreds of nominations recognizing the talents and contributions of many women working in the FinTech industry. With this report, we strived to assemble a diverse collection of interviews featuring women in growth and leadership phases of their careers in order to showcase new perspectives, inspiring professional journeys, and advice. The report features more than 30 exclusive interviews with Rising Stars in FinTech detailing their inspirations, challenges they confronted, opportunities they seized, mentors that have guided them along the way, and each person’s unique path to success in the FinTech industry.

Blockchain Accounting & Tax Solutions: Automation for the Digital Assets Ecosystem

As digital assets became more widely accepted, the need for corresponding tooling to meet accounting, reporting and tax requirements of both individuals and corporate users grew. Initially operating largely out of sight, tax authorities across the globe noted the surging value of digital assets and the increasing number of retail and institutional players within new digital asset markets. Following a long period in which cryptocurrency traders and participants in the broader ecosystem were largely left to their own devices, tax authorities now apply increasingly elevated levels of scrutiny and enforcement action.

B2B Payments: The Last Major Bastion of Paper-based Payments and Processes

The business-to-business (B2B) market remains one of the last major global opportunities for payment digitization. Not only is the market still plagued by widespread manual processes and inefficient payment methods, but it is also a massive market estimated at nearly $29 trillion in the U.S. alone. Today, checks still shockingly account for nearly 50% of B2B payments. Moreover, manually intensive payment methods are more likely to lead to high error and failure rates, making companies vulnerable to security risks and increasing costs. Consequently, the rush is on to bring more efficient, digital payment solutions to businesses, both large and small.

The Blockchain Economy

Activity surrounding blockchain, cryptocurrencies, and other digital assets has surged over the past few years. As a result, a true "blockchain economy" has emerged as billions of dollars are flowing through cryptocurrencies and other digital assets such as non-fungible tokens (NFTs) every day. Retail and institutional adoption continues to accelerate in pace, and the ecosystem may be on the precipice of its largest evolution yet given the growing interest in decentralized finance (DeFi). The blockchain economy continues to grow and develop new use cases, though there remain significant technological, organizational, and behavioral challenges that will need to be addressed before the technology becomes fully integrated with the existing global economy.

Women in FinTech: Redefining the Future of FinTech – 2022 Edition

FinTech is one of the few industries that brings together two traditionally male-dominated fields – finance and technology. However, many companies in finance, technology, and FinTech are recognizing the importance of diversity in the workplace. Additionally, a groundswell of FinTech companies that focus on women and their financial health has emerged in the industry.

This Report:

- Discusses trends around women in finance, tech, venture capital, and FinTech

- Showcases more than 15 exclusive interviews with female CEOs, founders, executives and investors

- Highlights 26 FinTech companies focused on women's financial health and wellness

- Profiles over 60 FinTech companies with female C-suite executives

- Features 24 investment firms focused on offering financing to female entrepreneur

The Race to the Super App

Following the lead of Alipay and WeChat Pay in China, the race is on to develop Super Apps around the globe. While the Super Apps in the West may not encompass as many everyday activities as the leading Chinese Super Apps given structural market differences across regions, there is a clear battleground emerging to provide one seamless app with all of the key financial services needed by mainstream consumers. We see two Super App models emerging across the globe: the financial services-led, winner-take-all model, and the aggregator model. There are numerous examples where some combination of savings, lending, brokerage, wealth management, crypto trading, and personal financial management solutions are all coming together under one roof. This report discusses the history of the Super App, the various Super App models that have emerged globally, and examines the global landscape and the players that are leading the way as well as new potential entrants across all key geographies.

Buy Now Pay Later - Revolutionizing Traditional Credit With Convenience, Data & eCommerce

The traditional credit industry is transforming as strong growth in eCommerce and technological innovation pave the way for the proliferation of alternative payment methods, including buy-now-pay-later (“BNPL”) options. BNPL payment methods increase consumers’ purchasing power and financial flexibility through installment payment plans typically offered at 0% APR. These options are seamlessly built into the checkout experience and help merchants increase conversion and average order values. While BNPL became popular as online “Pay in X” solutions, we are seeing a convergence between traditional point-of-sale financing and BNPL solutions as both move toward omnichannel and multi-product offerings.

Youth-focused FinTech Platforms Attract Investor Attention

New FinTech platforms continue to gain market share globally, particularly among younger, tech-savvier consumers who don’t require physical branches and are drawn to their lower fees and user-friendly apps. While many leading consumer FinTech platforms cater primarily to millennials, a number of well-funded players have emerged focusing on providing banking and financial services to teens and even younger kids.

The report profiles three youth-focused FinTech platforms that announced large financing rounds in rapid succession:

- Current’s $220 million Series D financing

- Greenlight’s $260 million Series D financing

- Step’s $100 million Series C financing

The report also profiles other players in the space including gohenry, Kard, Mozper, Revolut, Monzo, Tinkoff and Varo.

Open Banking – Rearchitecting the Financial Landscape

The proliferation of Open Banking standards could have a transformative impact on financial services in the coming years. Open Banking – a framework wherein banks open up their APIs and enable third parties to access customers’ financial data in order to provide new services – provides greater transparency to consumers, while also lowering the barriers to entry for new players. This should encourage heightened levels of innovation and competition in financial services, while also enabling banks to partner with and provide services to FinTech companies, rather than competing directly with them. Open Banking principles have also enabled the rise of Embedded Finance, which empowers any company to offer financial products directly to their customers in their core platforms or apps.

Women in FinTech 2021 Interview Compilation

In 2021, FT Partners published the first edition of our Women in FinTech report. We featured 31 exclusive interviews with female CEOs, Founders, Executives and Investors in the FinTech space including...

- Amy Nauiokas, Founder & CEO of Anthemis

- Abby Adlerman, Founder & CEO of Boardspan

- Elisabeth Carpenter, COO of Circle

- Allison Barr Allen, Co-Founder & COO of Fast

- Betsy Cohen, Chair of FinTech Masala

- Emmalyn Shaw, Managing Partner at Flourish Ventures

- Karen Cahn, Founder & CEO of IFundWomen

- Vidya Peters, COO of Marqeta

- Annie Lamont, Co-Founder & Managing Partner of Oak HC/FT

- Amrita Ahuja, CFO of Block (Square)

- Shivani Siroya, Founder & CEO of Tala

2020 InsurTech CEO & Executive Interview Compilation

Over the course of 2020, FT Partners published numerous, exclusive CEO / Executive interviews with InsurTech companies innovating along the insurance value chain. The report features all 13 interviews from 2020 along with new 2021 updates from the CEOs and Executives.

Video Conference Recap: Stablecoins - The Fabric of a New Global Payments Infrastructure

On September 24, 2020, FT Partners hosted a live VIP video conference call focused on the rapid rise of stablecoins and the massive potential implications for the global financial infrastructure. The panel featured leaders in the digital asset space from Circle, Compound, Digital Currency Group and Visa. Panelists provided perspective on fundamental value propositions for programmable currencies, regulatory trends, new markets like Decentralized Finance (DeFi), and the aggregate transformative impact for businesses and individuals globally. Following the broader session, Jeremy Allaire, CEO of Circle, provided further insights on the role of Circle Platform Services as an accelerant to the adoption of stablecoins and perspectives on USDC, the fastest-growing regulated stablecoin.

Healthcare Payments: Consumerization and Digitization Create a Massive FinTech Opportunity

The healthcare industry, which accounts for 18% of GDP in the United States, is transforming as the industry adapts to more widespread adoption of digital technologies and confronts the challenges of ever rising costs and the pressures it puts on patients, hospitals and physicians (“providers”), insurance companies (“payers”), the government, and other participants. Similar to other areas of financial services, technology is only becoming more important to the delivery of financial services related to healthcare, resulting in the emergence of a Healthcare Payments ecosystem. Innovative business models and new technologies are eliminating inefficiencies within the current system, and challenging incumbents and traditional models. The 280+ page report features a detailed overview of the U.S. healthcare industry, an analysis of key trends affecting the market, a comprehensive industry landscape, recent financing and M&A activity in the space, profiles of more than 50 key Healthcare Payments / Healthcare IT companies, as well as exclusive interviews with more than 20 industry leaders and executives.

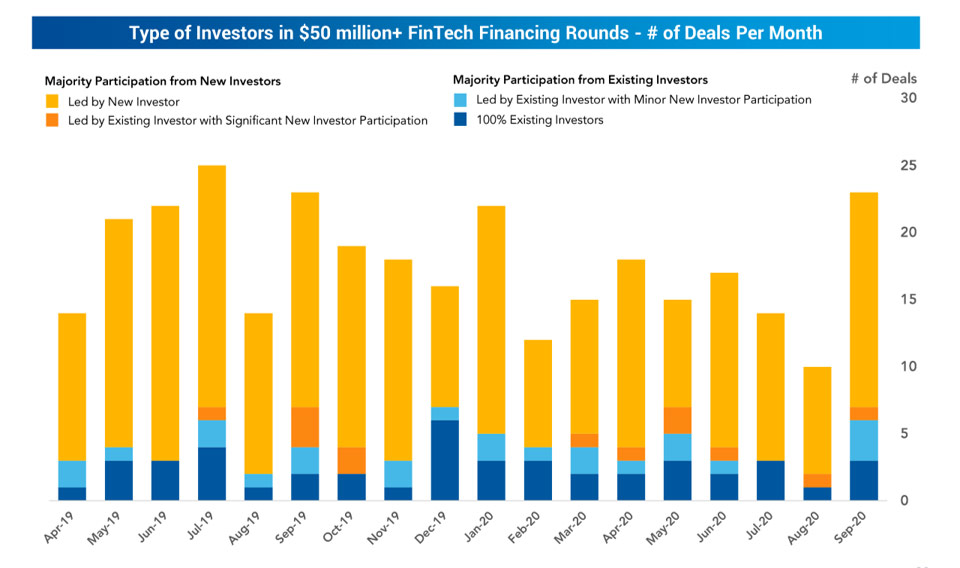

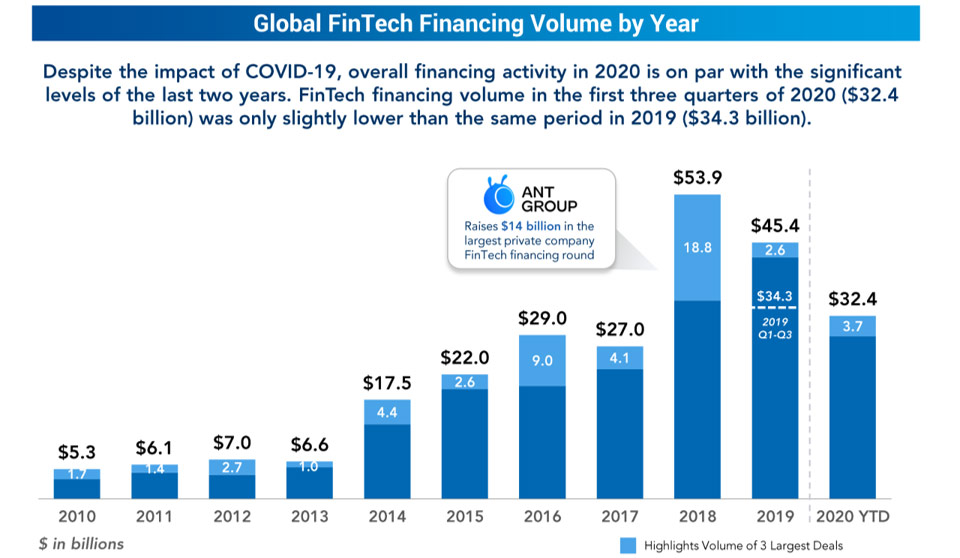

Understanding the Impact of COVID-19 on FinTech

The rapid decline in both economic activity and the broad stock market averages, along with the lingering uncertainty around the timing of the return to “normal” economic activity due to the COVID-19 pandemic, will undoubtedly negatively impact FinTech financing and M&A activity. Relative to many other areas of the economy, FinTech should hold up well, as many FinTech businesses operate in a largely digital environment or are helping financial institutions and enterprises improve their operations by providing mission critical services. Moreover, the secular trends driving growth in FinTech businesses are likely to remain intact (and perhaps accelerate) as the coronavirus impact recedes. Key discussion topics of the report include: An overview of the pandemic’s impact on FinTech, public and private markets, and the broader economy; A wealth of proprietary data quantifying the impact on consumer spending and small businesses; Highlights of recent investor activity in the FinTech space.

FinTech Meets Alternative Investments: Innovation in a Burgeoning Asset Class

Demand for alternative assets remains strong as investors and plan sponsors seek asset diversification, higher yields, and uncorrelated returns. As a result, alternatives are a clear bright spot in the asset management industry. Despite significant headwinds, successful alternative asset managers are growing while many traditional asset managers have or are considering moving into the space. A similar trend is playing out among investment service providers -- traditional servicers are expanding their capabilities to include alternatives. As demand grows for alternative assets, a new FinTech ecosystem is developing to help investors, investment managers, and service providers to access new asset classes and manage their investments and operations with new data, software, and platforms.

The Rise of Challenger Banks: Are the Apps Taking Over?

The banking sector is experiencing a major shift globally, as Challenger Banks are becoming increasingly formidable competitors to traditional banks and have begun to capture significant market share. Furthermore, the lines between banks and other consumer financial services providers are blurring, with several alternative lenders and robo-advisors beginning to offer banking products to their customers. E-commerce / internet giants are also jumping into the fray with Google and Amazon, among others, beginning to offer banking products. In response to the emergence of Challenger Banks, a number of incumbent banks have launched their own FinTech brands, and traditional financial institutions will likely turn to FinTech solution providers in order to defend their turfs.

Brazil’s Emerging FinTech Ecosystem: A Fertile Environment for Disruption and Innovation

Brazil is in the midst of a FinTech revolution as the confluence of a number of forces has created a very fertile environment for innovation and disruption across various financial, technology and business services. With the world’s fifth largest population, the ninth largest economy and a government encouraging greater competition for a highly concentrated banking ecosystem, Brazil represents a very attractive market and a huge growth opportunity for technology-driven financial solutions across Payments, Banking, Lending, Insurance, Wealth Management, and other sectors.

Beyond the Credit Score: What’s Next in Consumer Credit Management

Today, while many companies offer free credit scores, few offer free credit monitoring, and even fewer offer key insights about what impacts consumers' credit worthiness. After getting access to their credit scores, consumers are often at a loss of what to do and are largely left on their own to make important credit decisions. This contrasts with the asset side of consumers' balance sheets where financial advisors and, increasingly, robo advisors are using data and analytics to alleviate consumers of the burden of making investment decisions for their specific goals. Consequently, we expect financial service providers to move beyond offering free access to credit information and move towards providing complete credit lifecycle management solutions that not only enable consumers to understand their credit profile, but also directly help them improve their scores and leverage their position in order to obtain the most optimal credit products at any given moment in time.

WealthTech — The Digitization of Wealth Management

This report provides an in-depth examination of the dramatic changes sweeping across the wealth management industry. The traditional investment management and registered investment advisor (“RIA”) industries are facing numerous threats, and while firms in the industry recognize the need to respond, technology-driven innovation is not a core expertise of most RIAs and investment managers. Consequently, there has been a groundswell of FinTech companies bringing digital capabilities to the traditional wealth management industries. Collectively, we label this segment of FinTech as WealthTech.

Prepare for the InsurTech Wave: Overview of Key Insurance Technology Trends

This in-depth report looks at the major waves of innovation and disruption that are beginning to radically alter the insurance industry. The insurance industry, unlike many other areas of financial services, has not yet been substantially disrupted by new technologies and transformative business models. However, the industry now appears to be at a key inflection point as many different constituents in the FinTech ecosystem have their sights squarely set on insurance as the next great opportunity.

Auto FinTech – The Emerging FinTech Ecosystem Surrounding the Auto Industry

As the automotive industry continues to innovate, consumers and businesses will expect the financial services and processes surrounding this massive industry to modernize and adapt as well. Similarly, as new advances change the way consumers and businesses use cars, both traditional financial services and FinTech companies can distinguish themselves by offering new, innovative solutions.