Buy Now Pay Later - Revolutionizing Traditional Credit With Convenience, Data & eCommerce

Executive Summary:

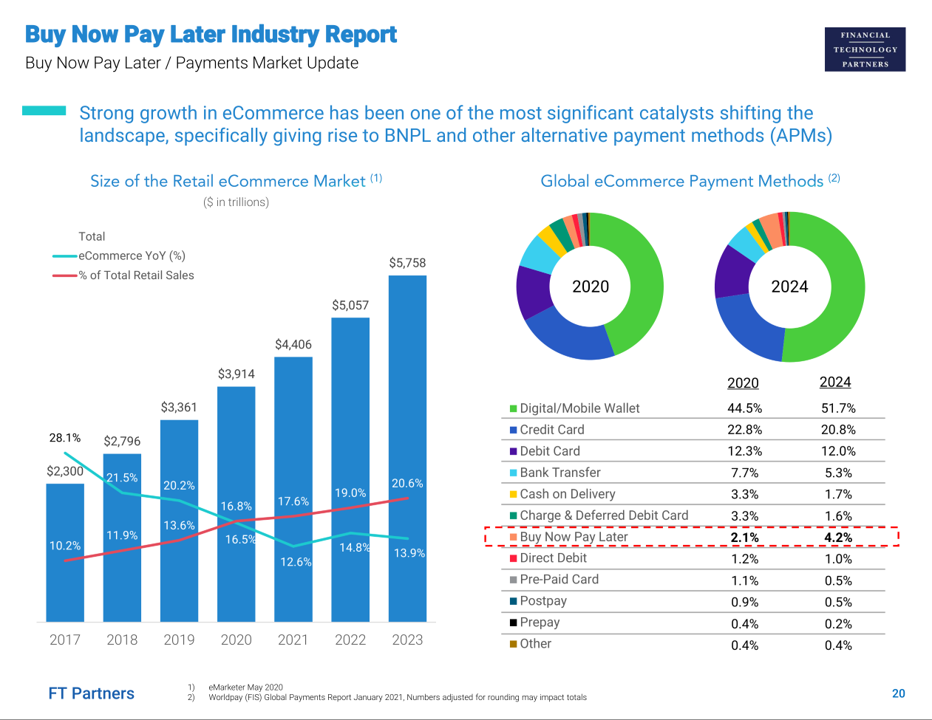

The traditional credit industry is transforming as strong growth in eCommerce and technological innovation pave the way for the proliferation of alternative payment methods, including buy-now-pay-later (“BNPL”) options. BNPL payment methods increase consumers’ purchasing power and financial flexibility through installment payment plans typically offered at 0% APR. These options are seamlessly built into the checkout experience and help merchants increase conversion and average order values. While BNPL became popular as online “Pay in X” solutions, we are seeing a convergence between traditional point-of-sale financing and BNPL solutions as both move toward omnichannel and multi-product offerings.

Report Features:

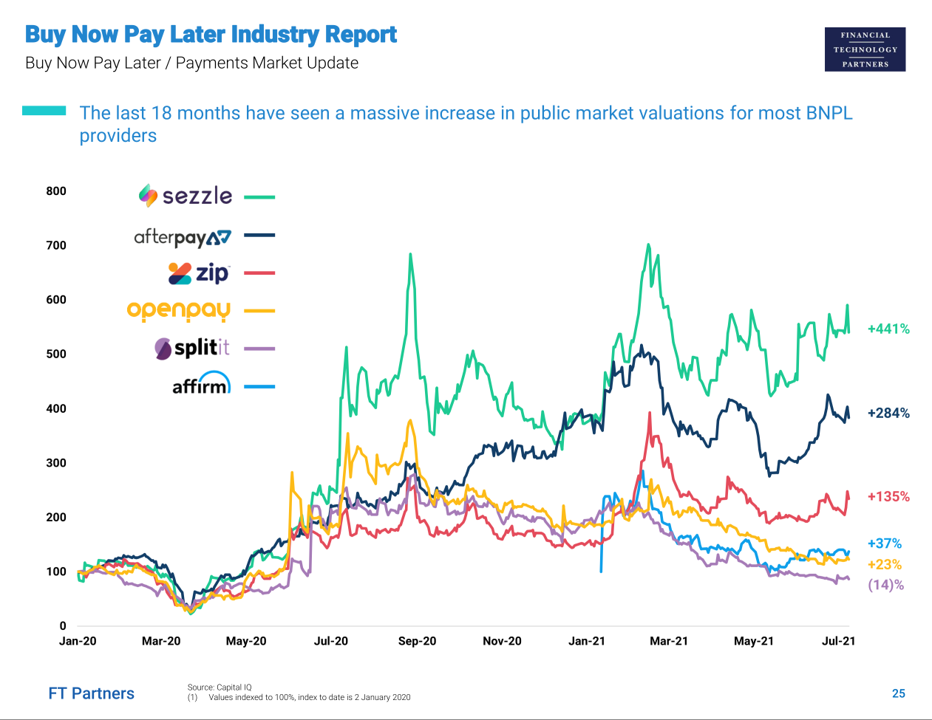

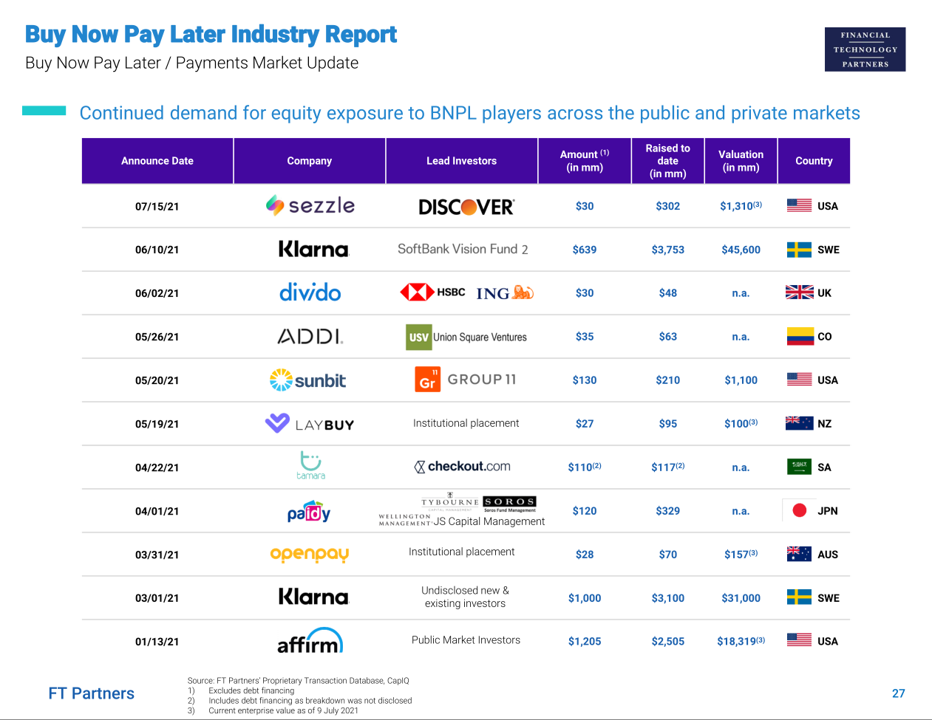

- An overview of recent developments and catalysts driving activity in the BNPL market

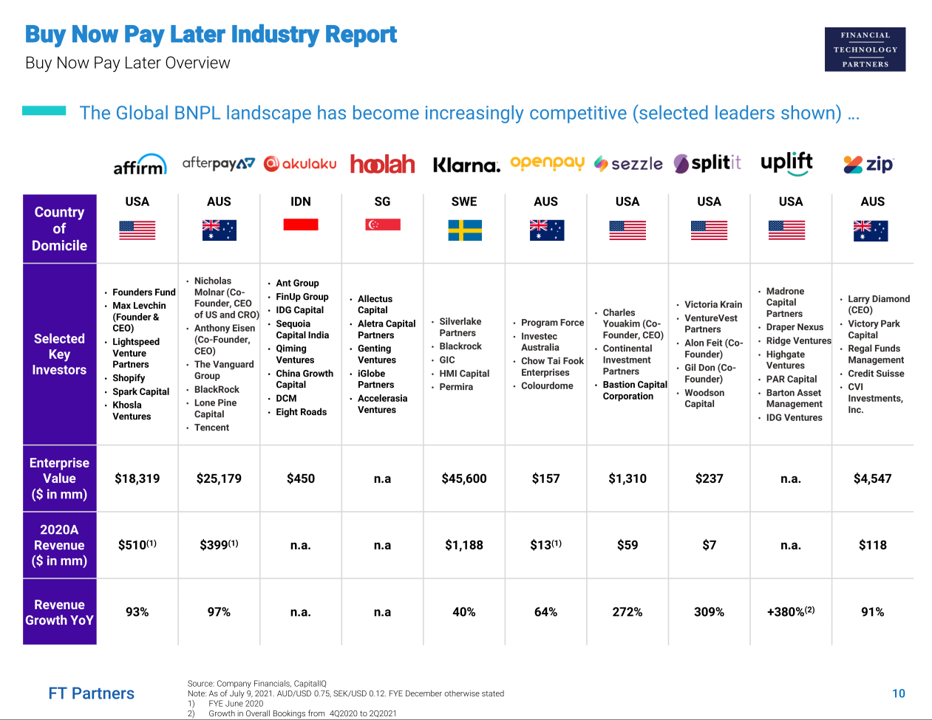

- A detailed landscape of companies in the BNPL space

- A proprietary list of financing and M&A transactions

- Exclusive interviews with CEOs and executives of 14 companies in the space

- Detailed profiles of 25+ BNPL providers

Featured Pages