WealthTech — The Digitization of Wealth Management

Executive Summary:

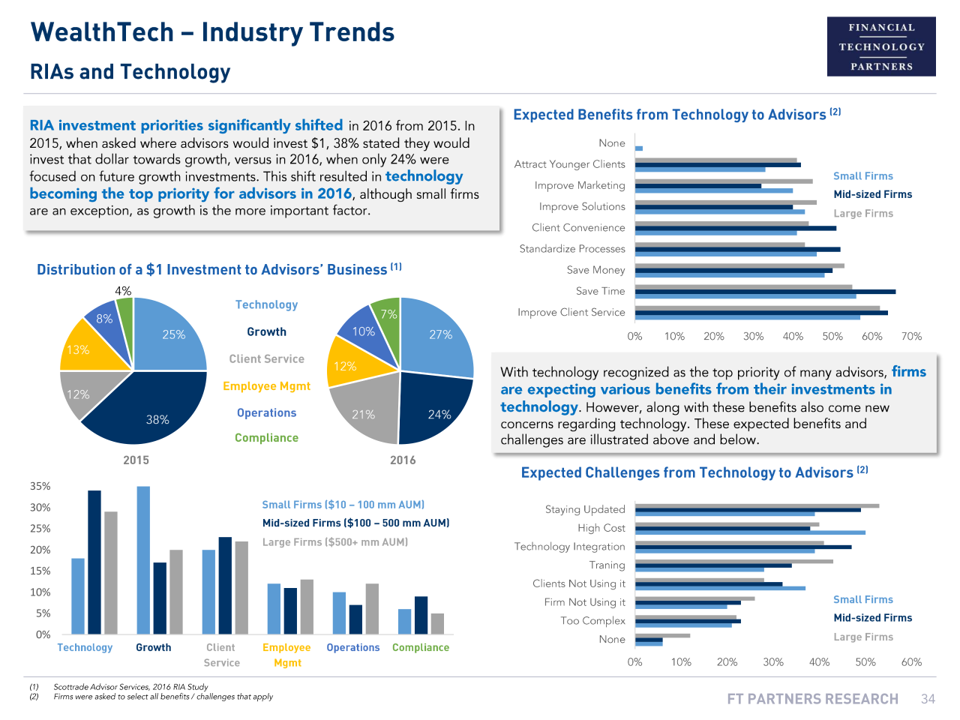

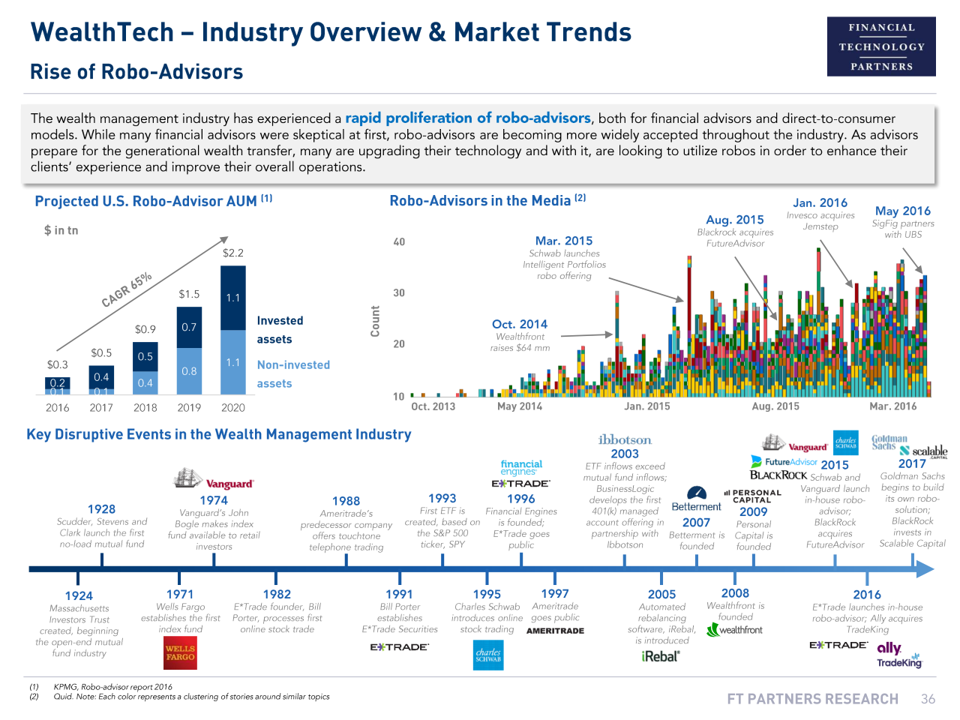

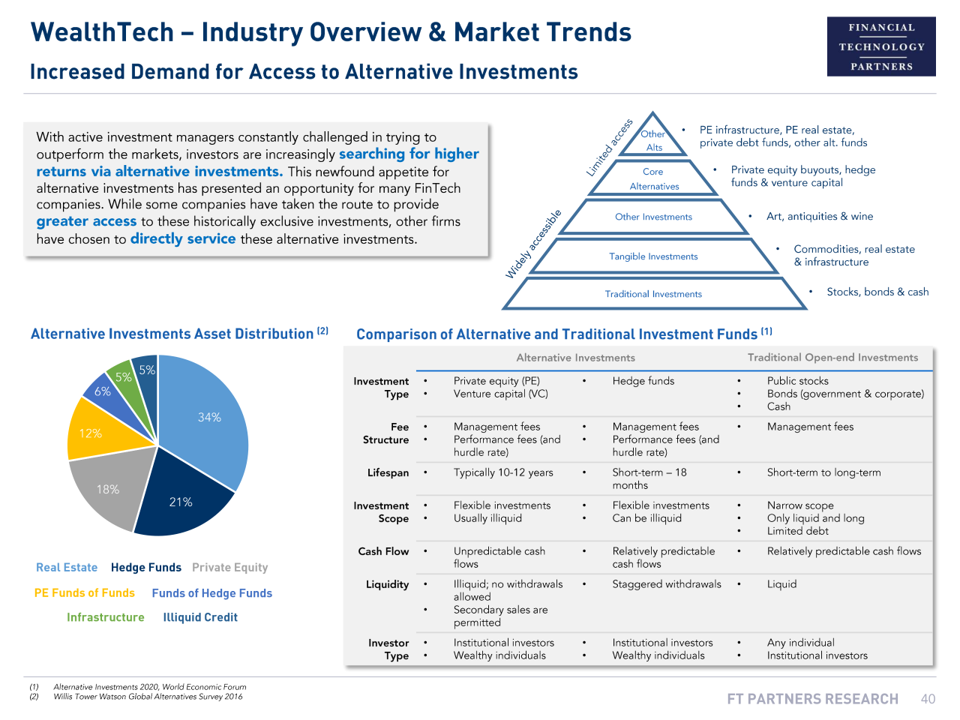

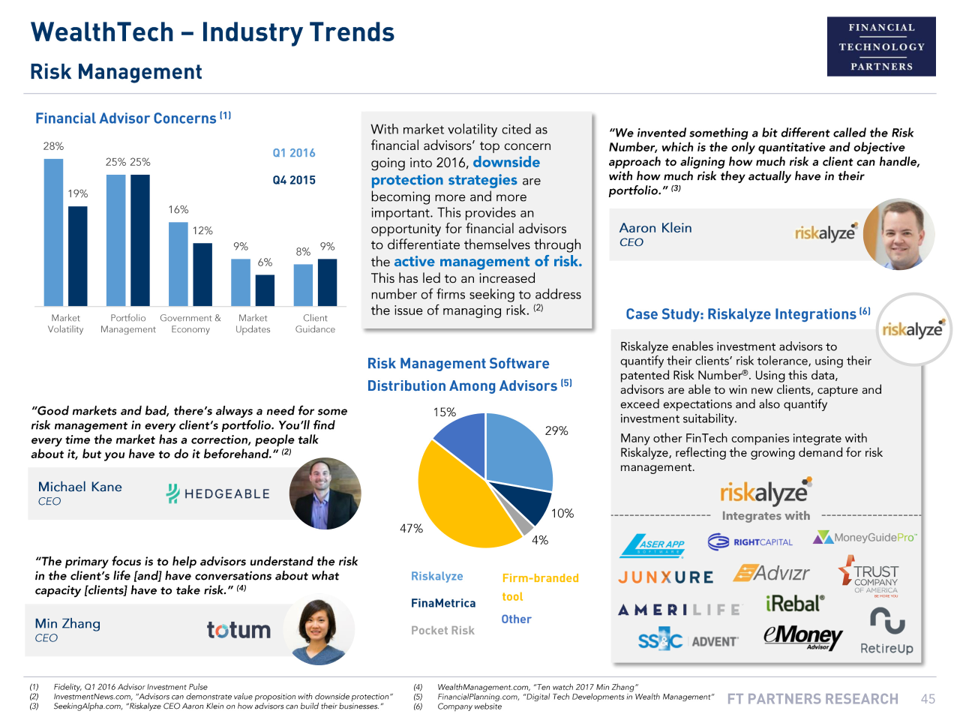

This report provides an in-depth examination of the dramatic changes sweeping across the wealth management industry. The traditional investment management and registered investment advisor (“RIA”) industries are facing numerous threats, and while firms in the industry recognize the need to respond, technology-driven innovation is not a core expertise of most RIAs and investment managers. Consequently, there has been a groundswell of FinTech companies bringing digital capabilities to the traditional wealth management industries. Collectively, we label this segment of FinTech as WealthTech.

WealthTech companies are targeting inefficiencies that span the entire wealth management value chain, from client prospecting to investing to portfolio management and reporting. Benefits include more efficient workflows, improved client experiences and greater transparency. Regardless of their value proposition, WealthTech companies are seeking to improve overall wealth management and investing.

This report highlights a number of key trends within the broader WealthTech industry such as:

- Growing number of advisors joining the independent channel

- Incumbent financial institutions are entering the robo-advice space

- Increased demand for alternative investments

- Financial planning trending towards goal-based approaches

- Higher levels of active risk management

- Commoditization of portfolio management software is leading to expanded offerings

- RIA custodians evolving into more holistic roles