FT Partners Quarterly InsurTech Insights and Annual Almanac

FT Partners is the only data source for comprehensive, global InsurTech deal activity covering M&A, Financing and IPO statistics and trends

FT Partners’ InsurTech Insights Reports are published on a quarterly basis, along with a comprehensive year-end Almanac. All information included in the reports is sourced from FT Partners’ Proprietary Transaction Database, which is compiled by the FT Partners Strategic Insights Team through primary research and data analysis. The reports feature M&A, financing and IPO statistics and trends as well as breakdowns by vertical, geography, investor-type and much more.

View our Global FinTech Insights and Almanac reports here.

Be sure to check back for quarterly updates and additions. All recent reports can be viewed or downloaded for free below.

Q3 2025 InsurTech Insights

Report Features:

- Q3 2025 and historical InsurTech financing and M&A volume and deal count statistics

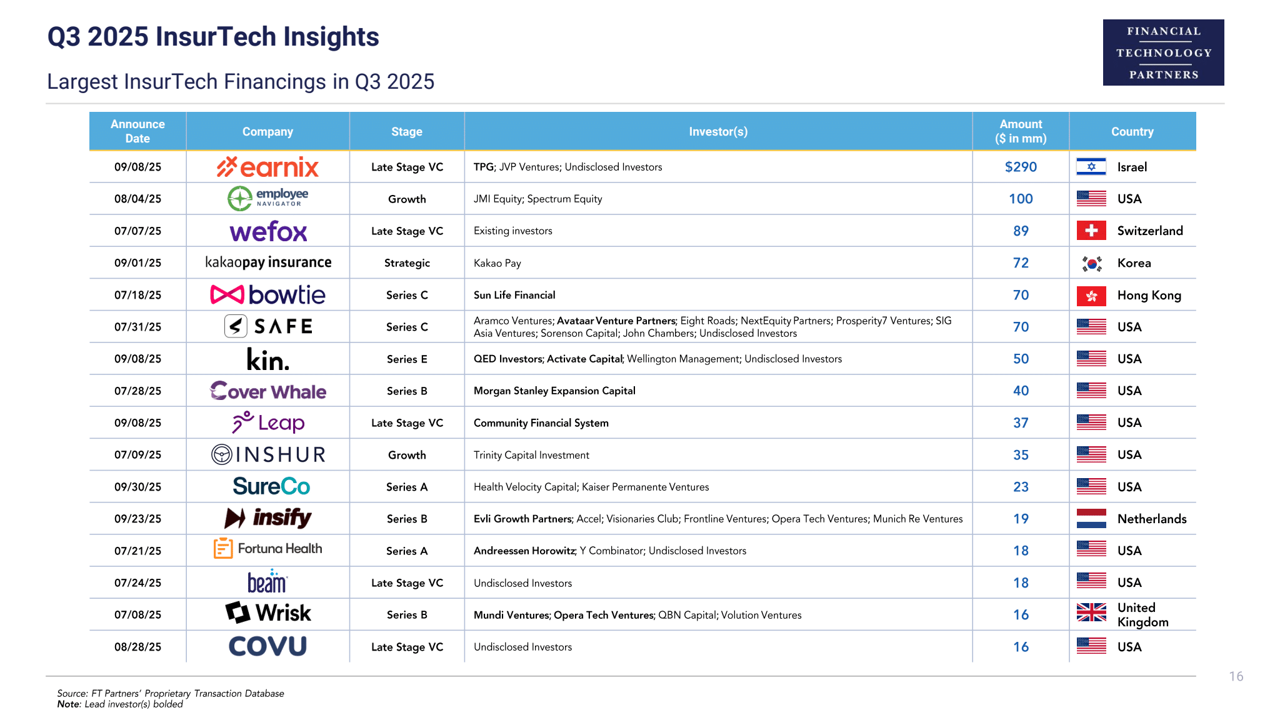

- Largest InsurTech financings and M&A transactions in Q3 2025

- Most active InsurTech investors

- Breakdowns by geography, product type and business model

- Corporate VC activity and strategic investor participation

- Other industry, capital raising and M&A trends in InsurTech

Key Highlights:

- InsurTech funding in Q3 2025 fell back to Q1 levels following a strong Q2 that was largely driven by Acrisure’s $2.1 billion raise. With only two financings exceeding $100 million announced during the quarter, the total – just over $1 billion – was buoyed by an influx of smaller deals.

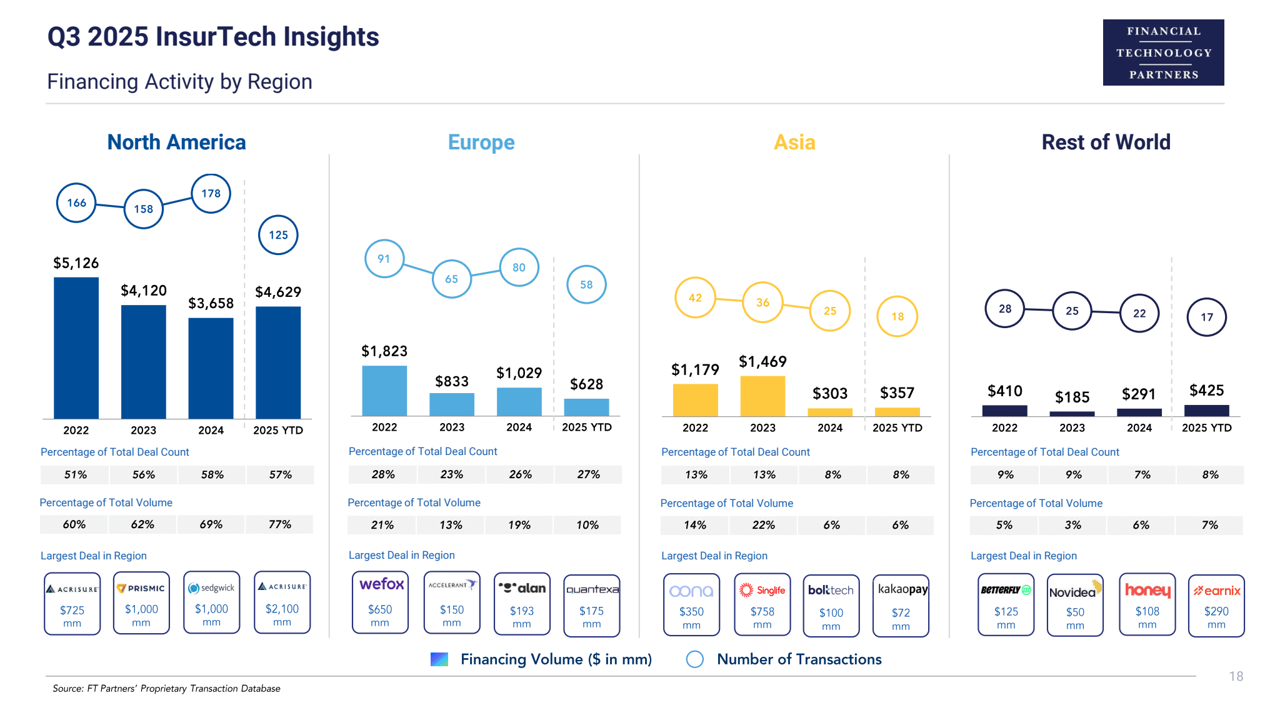

- Still, 2025 financing volume through Q3 already has surpassed the full-year 2024 level. On an annualized basis, InsurTech financing volume is tracking to overtake the levels of the last two years, possibly coming in just below 2022 ($8.6 billion), which was the second largest year ever.

- Financing volume in Asia, Africa and the Middle East in 2025 YTD has exceeded the full-year 2024 levels, with large capital raises for Earnix (Israel), KakaoPay Insurance (Korea), and Bowtie (Hong Kong) in Q3 2025.

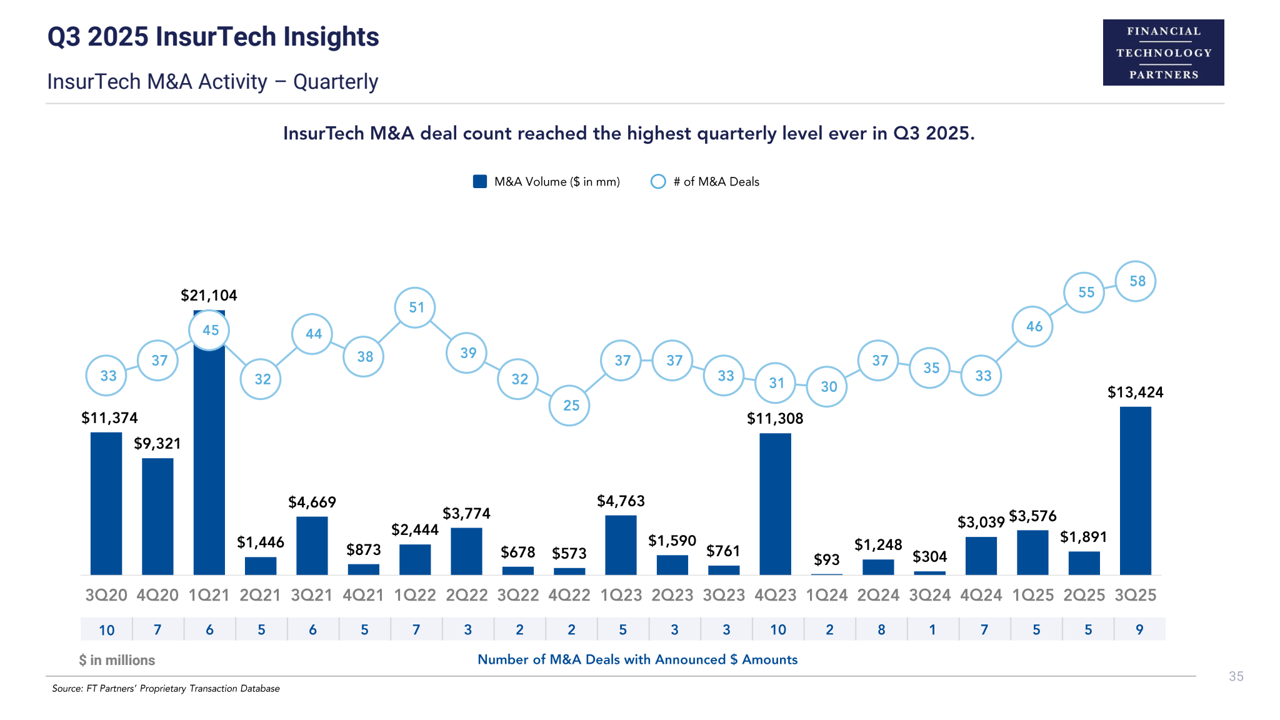

- InsurTech M&A deal count reached the highest quarterly level ever in Q3 2025, surpassing Q2 2025, reflecting an ongoing accelerated wave of consolidation in the sector.

View Prior Reports