FT Partners Proprietary FinTech Research:

Open Banking – Rearchitecting the Financial Landscape

Executive Summary:

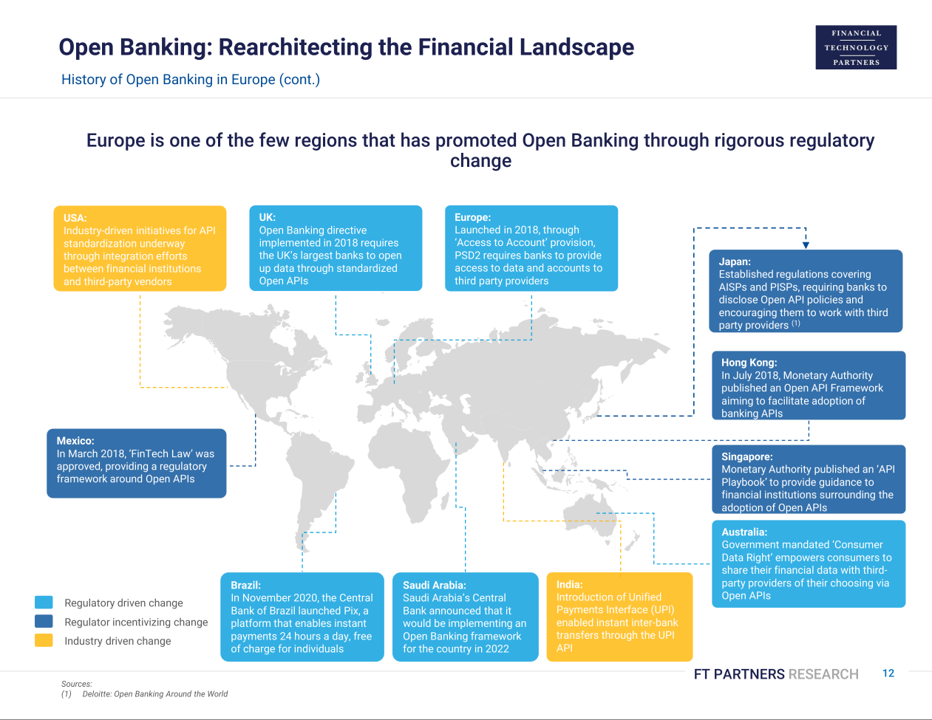

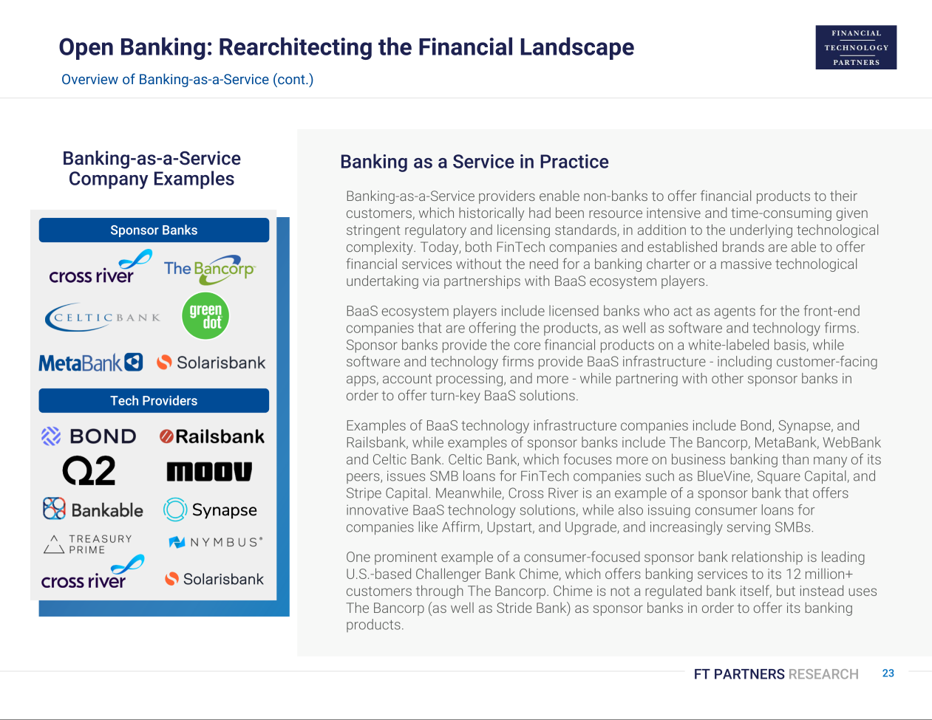

The proliferation of Open Banking standards could have a transformative impact on financial services in the coming years. Open Banking – a framework wherein banks open up their APIs and enable third parties to access customers’ financial data in order to provide new services – provides greater transparency to consumers, while also lowering the barriers to entry for new players. This should encourage heightened levels of innovation and competition in financial services, while also enabling banks to partner with and provide services to FinTech companies, rather than competing directly with them. Open Banking principles have also enabled the rise of Embedded Finance, which empowers any company to offer financial products directly to their customers in their core platforms or apps.

Report Features:

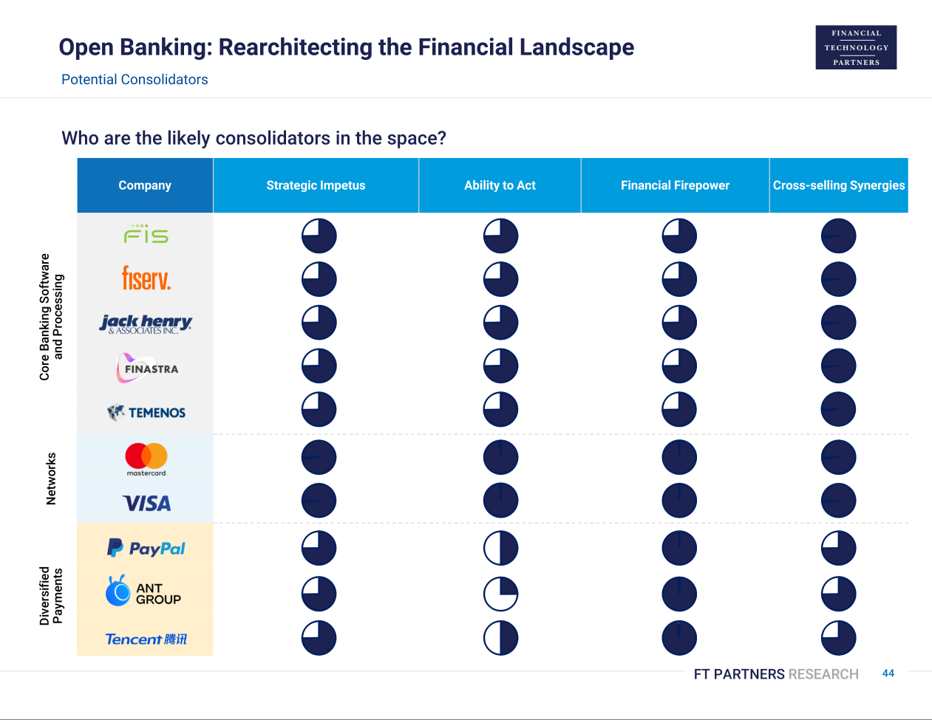

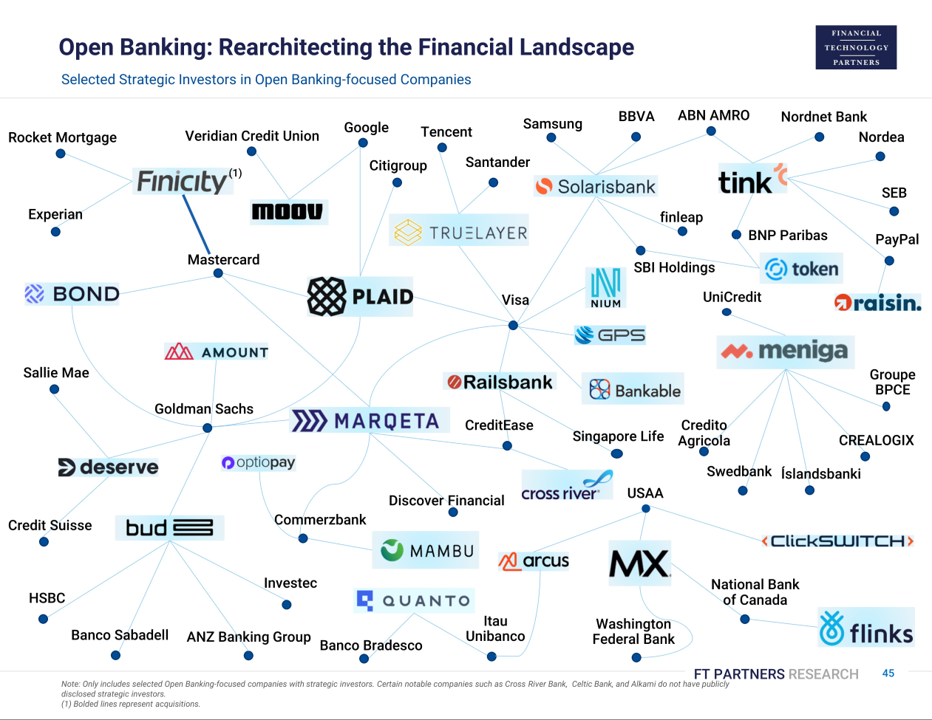

- An overview of trends related to Open Banking, Banking-as-a-Service, and Embedded Finance globally

- A detailed landscape of FinTech companies in the Open Banking and Embedded Finance space

- Proprietary list of financing and M&A transactions in the space

- Exclusive interviews with CEOs and executives of more than 20 high-profile Open Banking-related companies

- Detailed profiles of over 60 companies in the space

Featured Pages