FT Partners Proprietary FinTech Research:

Blockchain Accounting & Tax Solutions: Automation for the Digital Assets Ecosystem

Executive Summary:

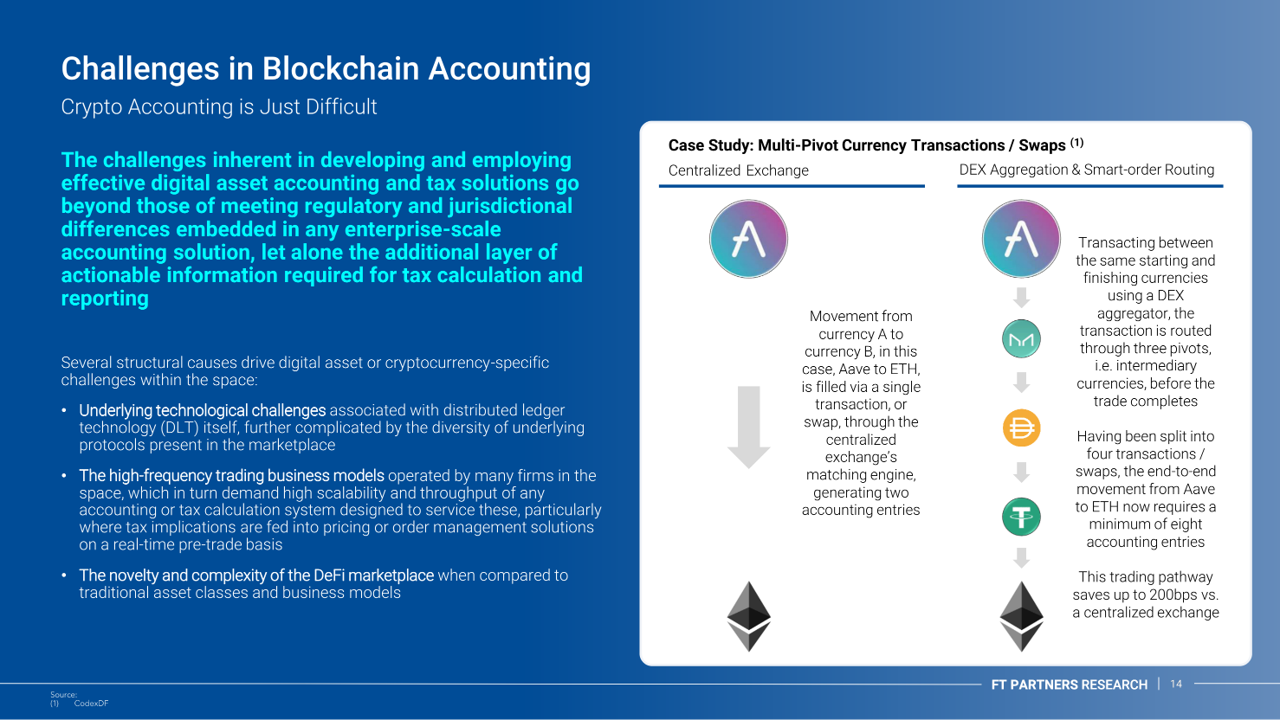

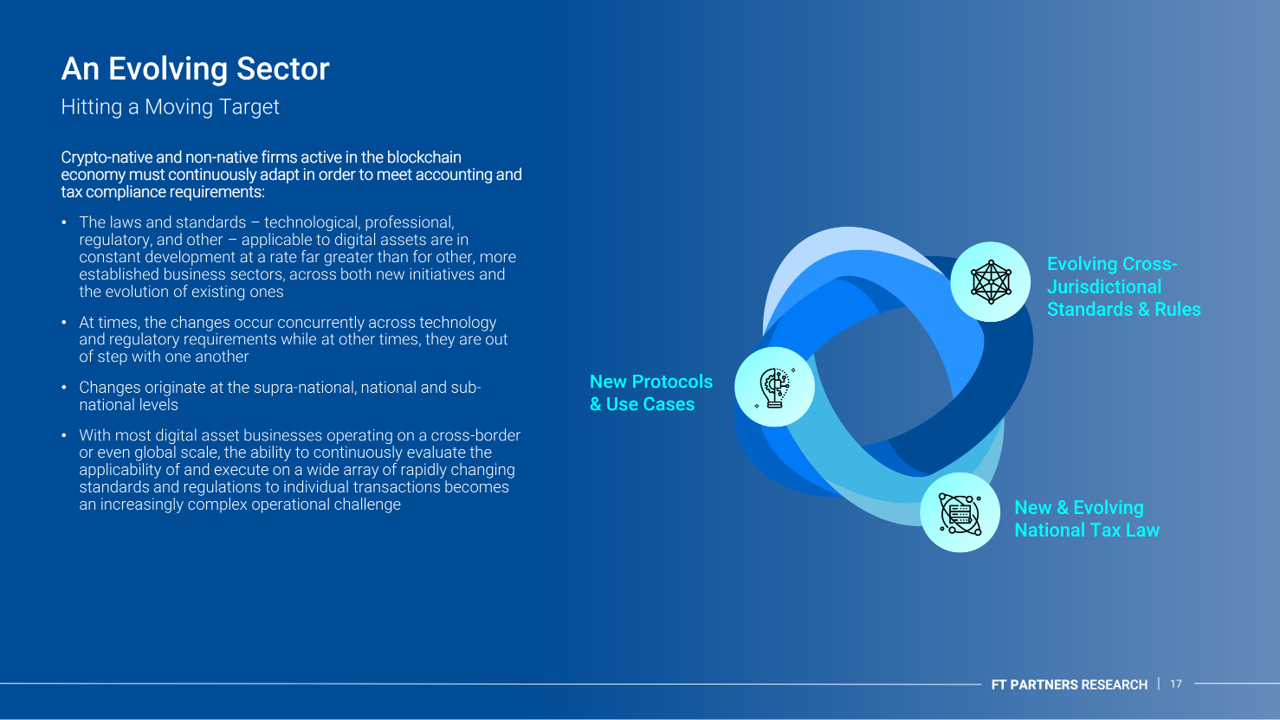

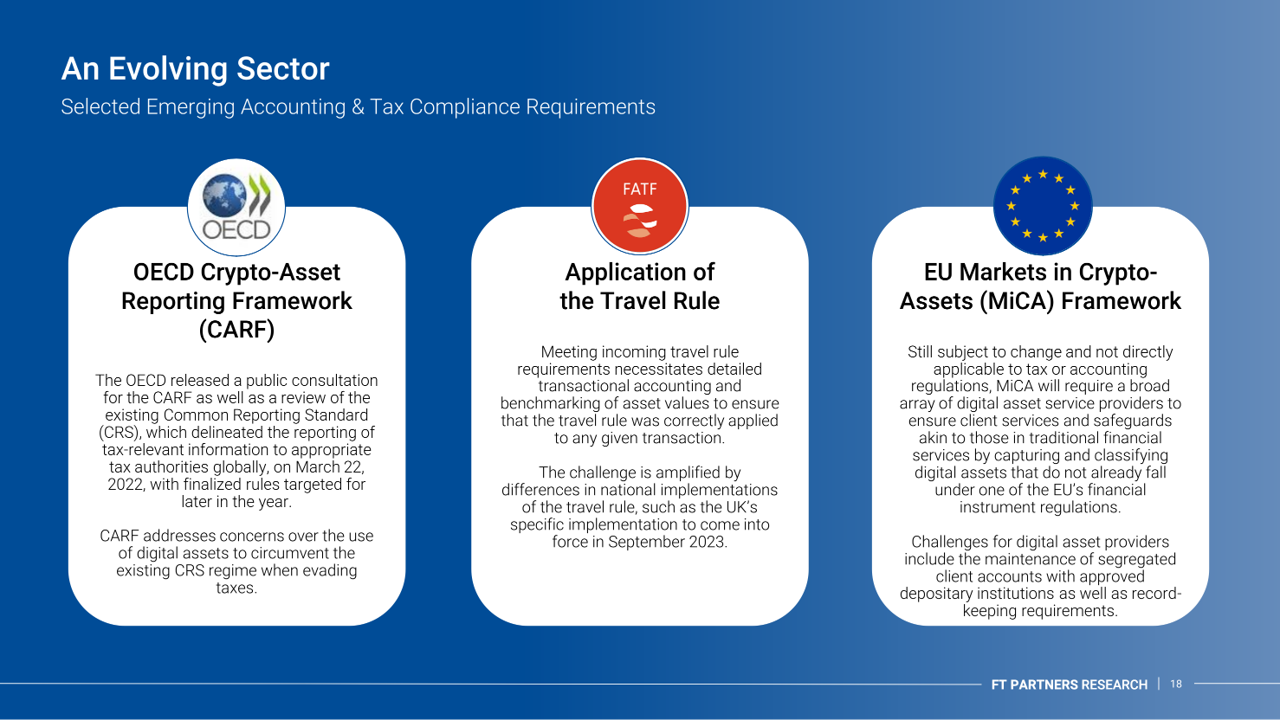

As digital assets became more widely accepted, the need for corresponding tooling to meet accounting, reporting and tax requirements of both individuals and corporate users grew. Initially operating largely out of sight, tax authorities across the globe noted the surging value of digital assets and the increasing number of retail and institutional players within new digital asset markets. Following a long period in which cryptocurrency traders and participants in the broader ecosystem were largely left to their own devices, tax authorities now apply increasingly elevated levels of scrutiny and enforcement action.

In response, consumers and enterprises seek the means to both reactively and proactively ensure compliance with tax regimes. In many cases, tax reporting requirements coincide with the need for enterprise-scale accounting and reporting solutions. Recent market turbulence as the consequence of FTX's failure further underlines and incentivizes the need for appropriate accounting tools and procedures, whether for risk management, reporting purposes, or tax loss harvesting.

Key discussion topics of the report include:

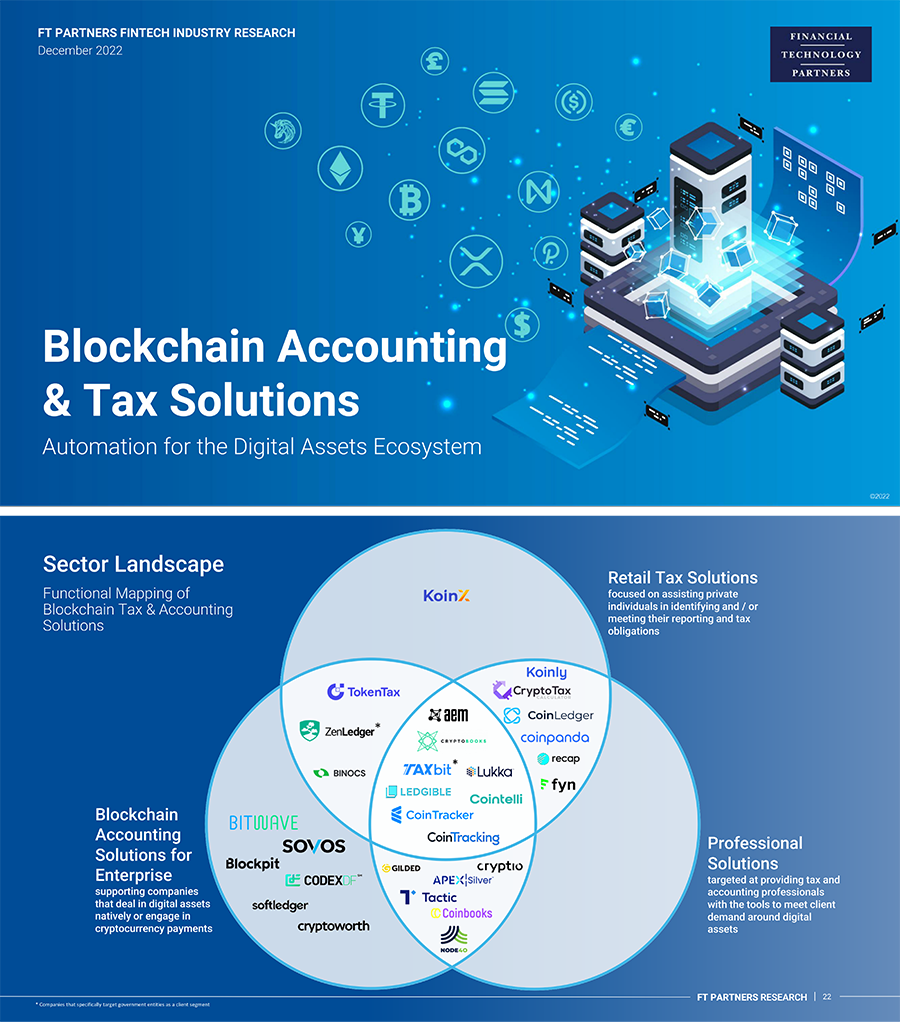

- An overview of solutions designed to help meet reporting and tax obligations across a range of jurisdictions, including both general accounting and tax-reporting specific solutions targeting individuals, organizations, and tax professionals

- A detailed landscape of companies in the space

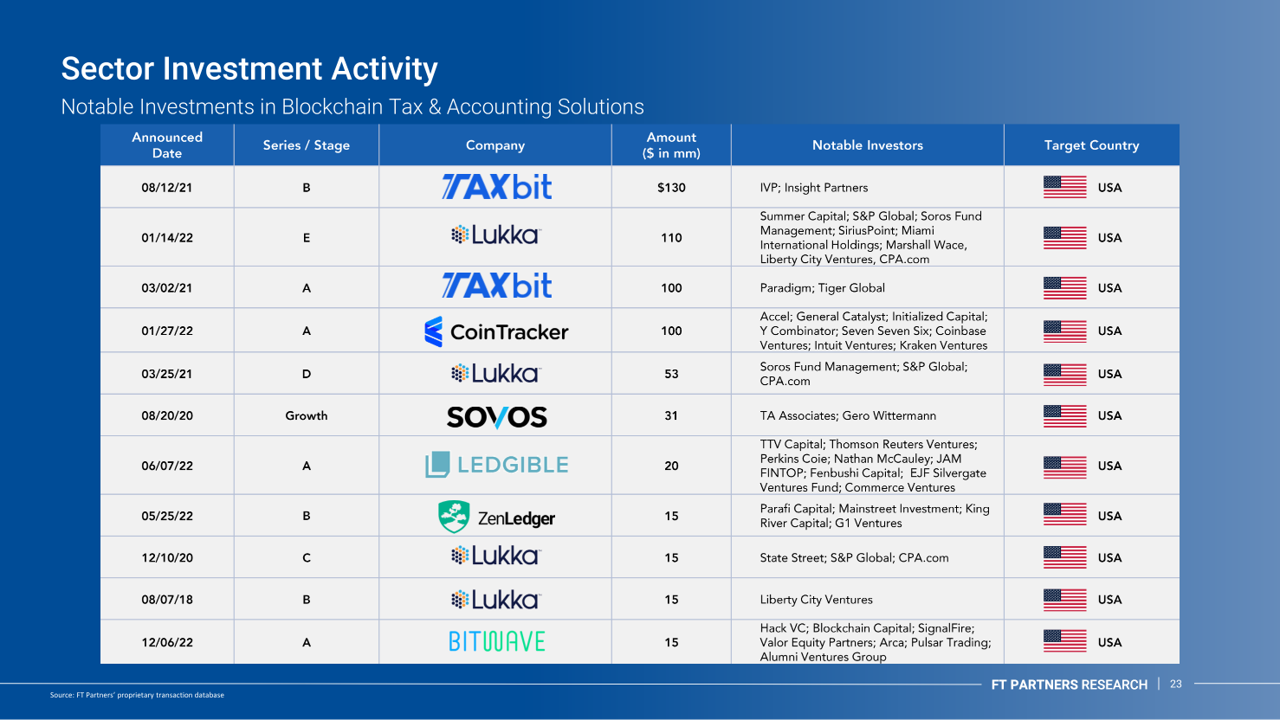

- A proprietary list of financing transactions

- Exclusive interviews with executives from eight leading companies

- Profiles of 30 highly relevant companies in the space