FinTech Meets Alternative Investments: Innovation in a Burgeoning Asset Class

Executive Summary:

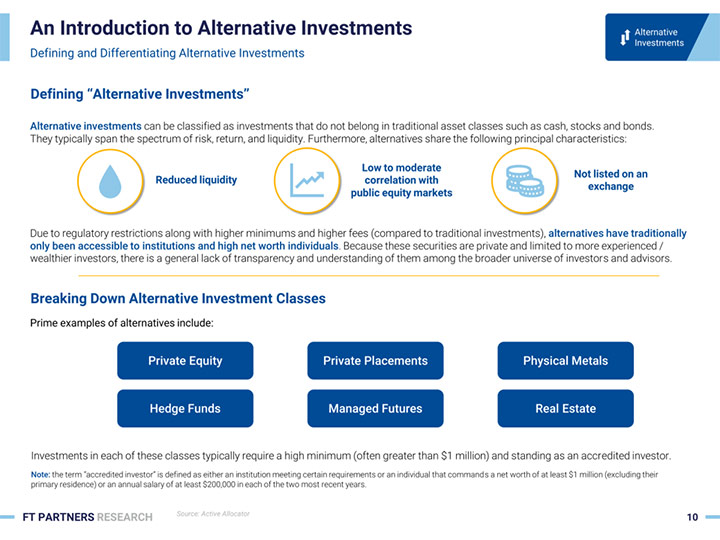

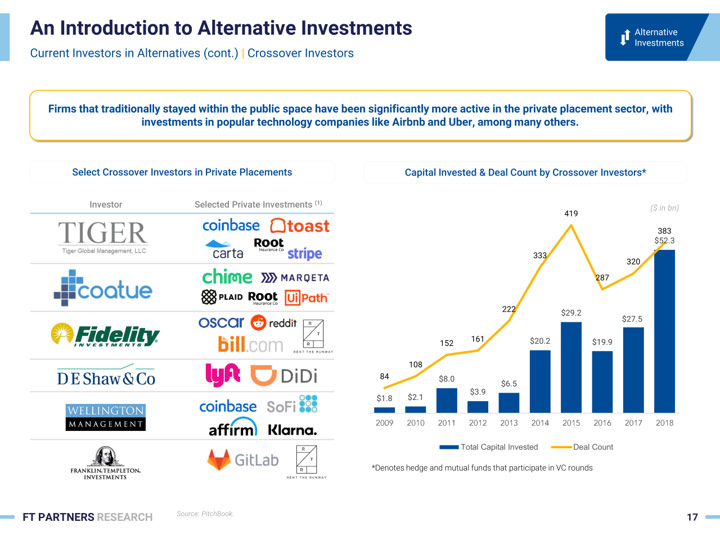

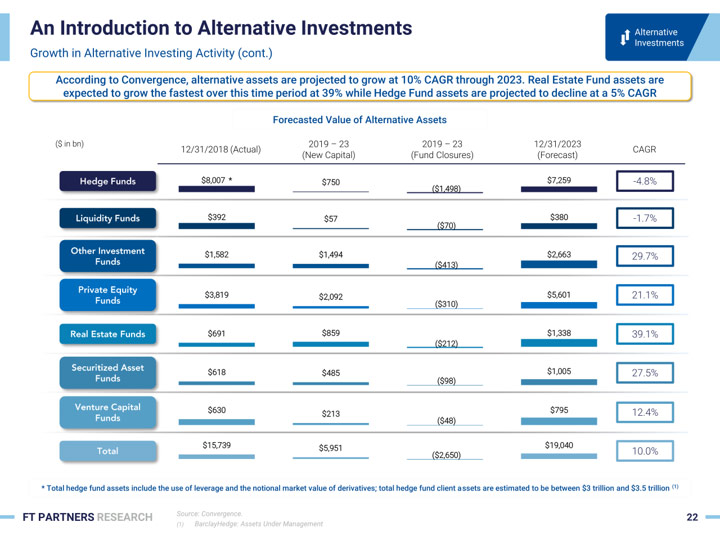

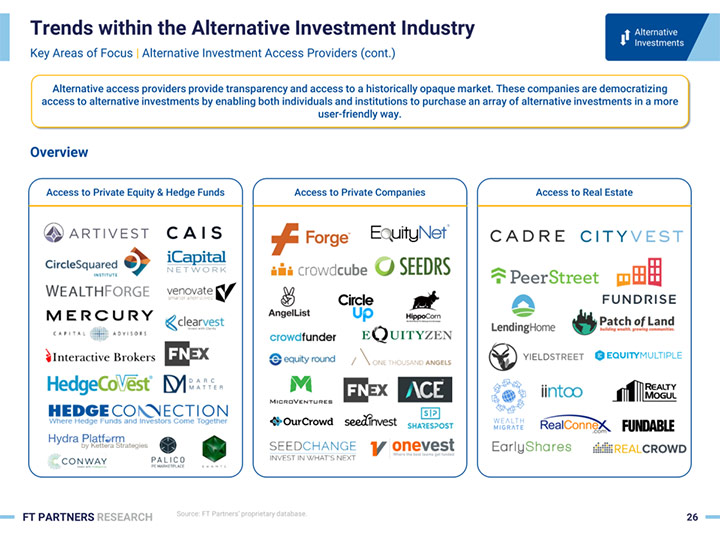

Demand for alternative assets remains strong as investors and plan sponsors seek asset diversification, higher yields, and uncorrelated returns. As a result, alternatives are a clear bright spot in the asset management industry. Despite significant headwinds, successful alternative asset managers are growing while many traditional asset managers have or are considering moving into the space. A similar trend is playing out among investment service providers -- traditional servicers are expanding their capabilities to include alternatives. As demand grows for alternative assets, a new FinTech ecosystem is developing to help investors, investment managers, and service providers to access new asset classes and manage their investments and operations with new data, software, and platforms.

Report Features:

- An overview of trends in the Alternative Investments space and the developing FinTech ecosystem around it

- A detailed landscape of FinTech companies servicing the Alternatives ecosystem

- Proprietary list of financing and M&A transactions

- Interviews with CEO and executives at 11 companies driving innovations in the Alternatives space

- Detailed profiles of 41 FinTech companies in the space

Featured Pages