FT Partners Quarterly Sponsor FinTech Insights

FT Partners is the only data source for comprehensive, global FinTech private equity deal activity.

FT Partners’ Sponsor FinTech Insights Reports are published on a quarterly basis. FinTech Sponsor Activity is defined as transactions in which a private equity sponsor, growth equity firm, or another control-oriented investor is involved in the following transaction types: take-privates, majority recapitalizations, significant minority recapitalizations, or other selected financings. All information included in the reports is sourced from FT Partners’ Proprietary Transaction Database, which is compiled by the FT Partners Research Team through primary research and data analysis.

View our FinTech, InsurTech and Crypto & Capital Markets Tech quarterly reports.

Be sure to check back for quarterly updates and additions. All recent reports can be viewed or downloaded for free below.

Q1 2024 Sponsor FinTech Insights

Report Features:

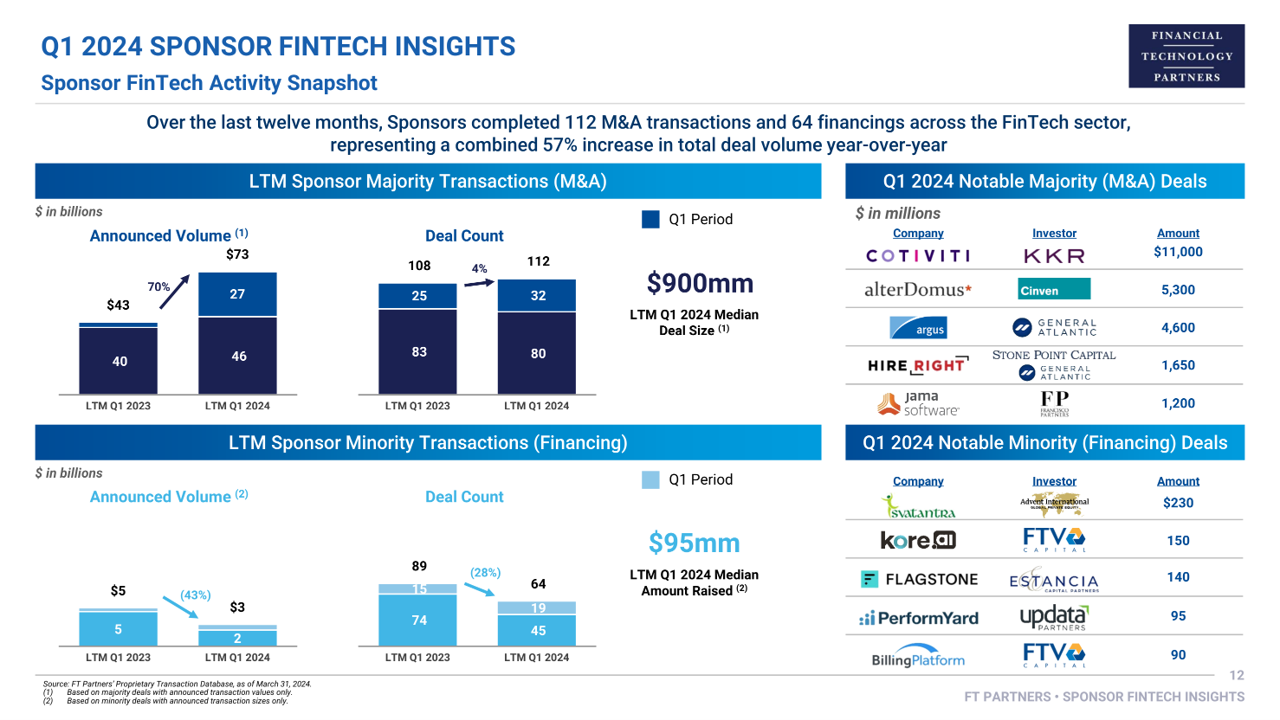

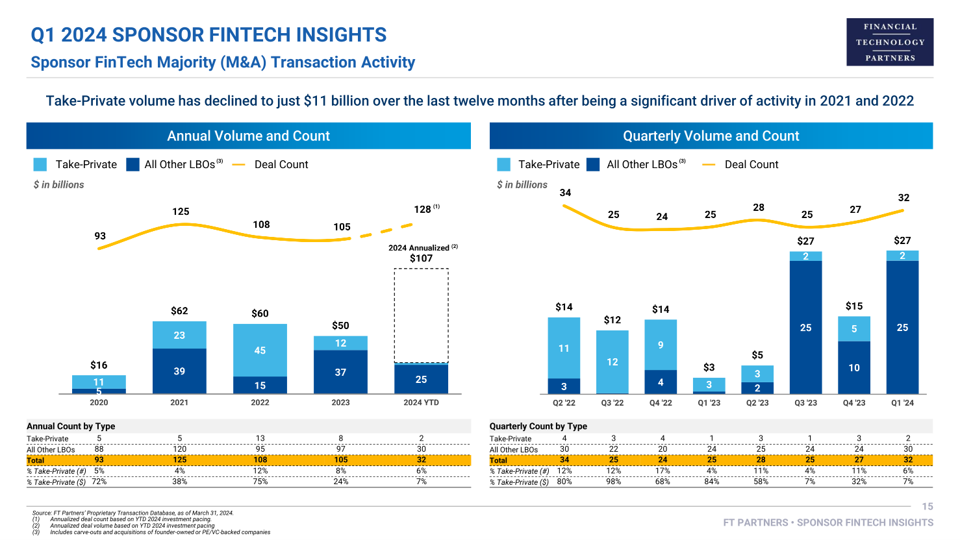

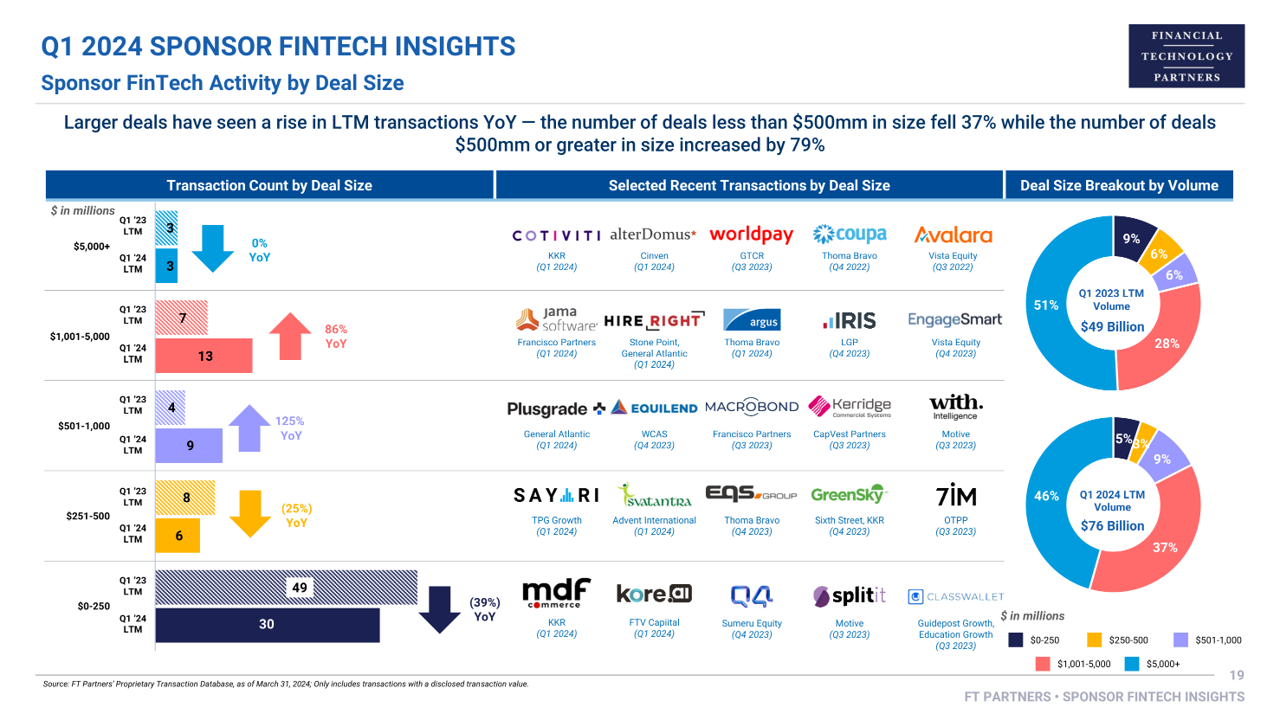

- Q1 2024, LTM and historical Sponsor-led FinTech deal volume and count statistics

- Recent activity trends dissected by deal type, geography, sector and size

- Analysis of recent FinTech Public-to-Private transactions

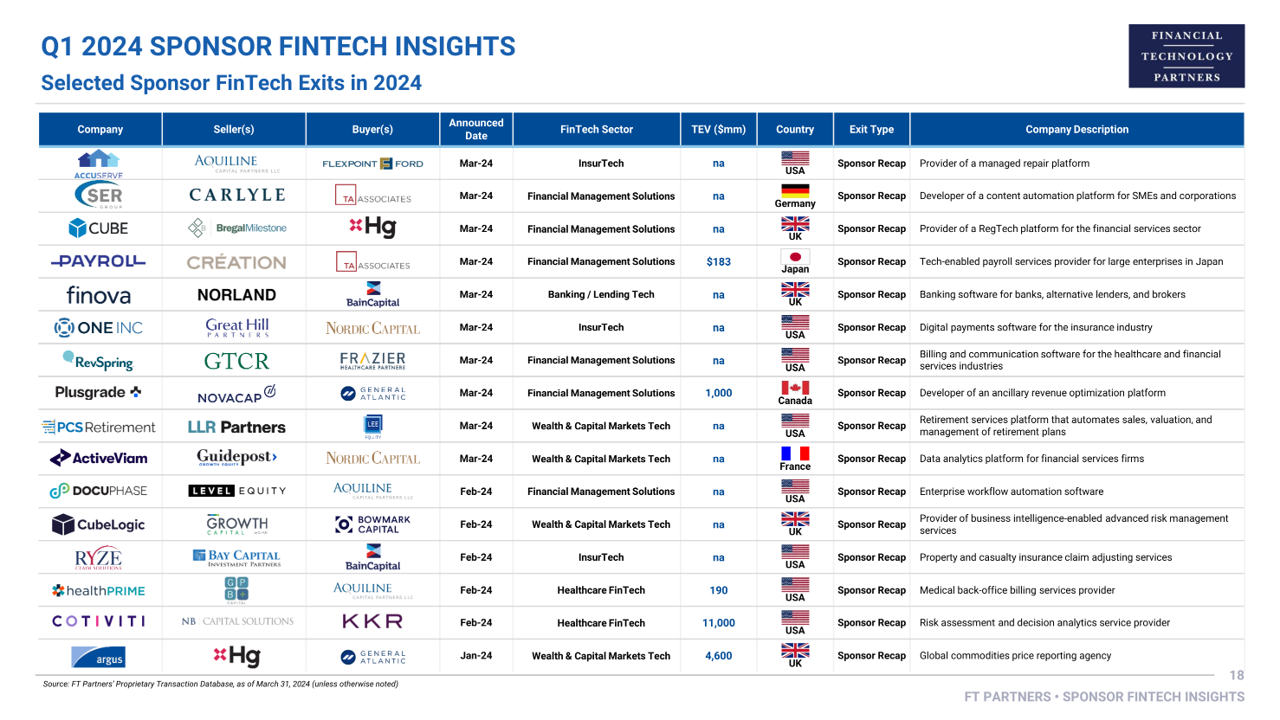

- Selected notable Sponsor exits in 2024

- List of most active Sponsors in FinTech over the last twelve months

- Transaction profiles on notable deals

Key Highlights:

- Q1 2024 announced private equity transaction volume of $28 billion was up significantly YoY following a tough deal-making environment in 2023 which logged $4 billion of announced transaction volume over the same period

- Excluding KKR's Cotiviti acquisition for $11 billion in February, transaction volume still totaled $17 billion, representing a 356% YoY increase from Q1 2023

- Private equity transaction count has also increased, although at a more measured rate than announced deal volume

- Sponsors completed 51 FinTech transactions in Q1 2024, representing a 28% increase YoY and a 34% increase QoQ

- Despite the uptick in Q1 2024 deal count, LTM transactions are down 11% from the prior 12-month period, highlighting just how muted FinTech private equity activity was throughout much of 2023

- Take-private transactions have stalled out over the past year, with P2P deal volume for LTM Q1 2024 down 68% from the same period last year

View Prior Reports