FT Partners Quarterly Crypto & Capital Markets Tech Insights and Annual Almanac

FT Partners is the only data source for comprehensive, global Crypto & Blockchain and Wealth & Capital Markets Tech deal activity covering M&A, Financing and IPO statistics and trends

FT Partners’ Crypto & Capital Markets Tech Insights Reports are published on a quarterly basis, along with a comprehensive year-end Almanac. All information included in the reports is sourced from FT Partners’ Proprietary Transaction Database, which is compiled by the FT Partners Research Team through primary research and data analysis. The reports feature M&A, financing and IPO statistics and trends as well as breakdowns by vertical, geography, investor-type and much more.

View our Global FinTech Insights and Almanac reports here.

Be sure to check back for quarterly updates and additions. All recent reports can be viewed or downloaded for free below.

Q1 2024 Crypto & Capital Markets Tech Insights

Key Highlights:

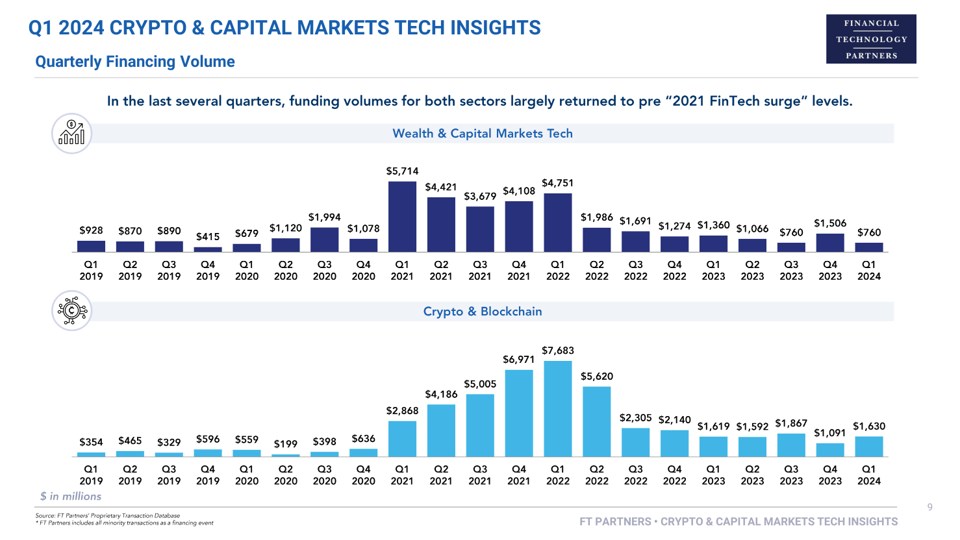

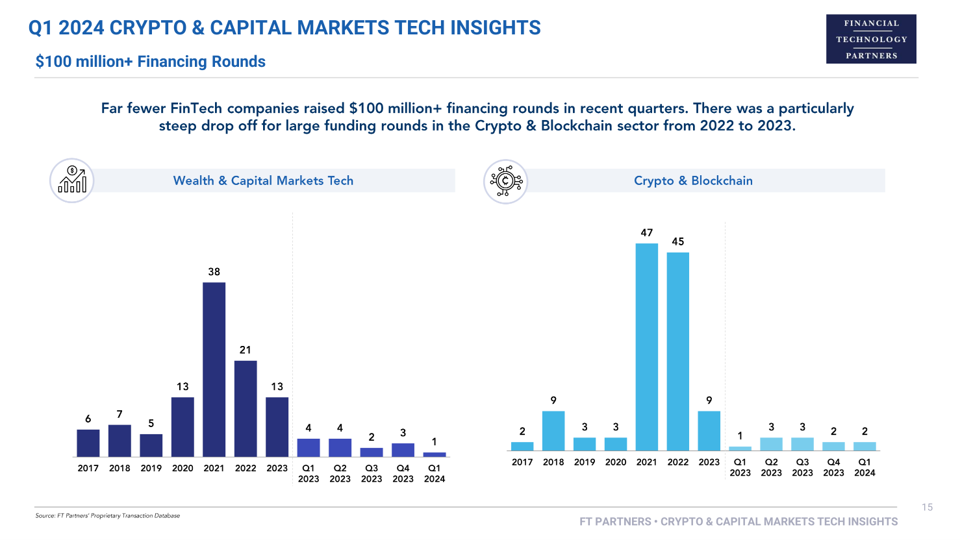

- Total private company funding volume for the Wealth & Capital Markets Tech sector fell 44% year-over-year in Q1 2024, totaling $760 million.

- Despite the low total dollar volume, the number of capital raises announced in Q1 2024 (105 deals) increased 40% over the total count from Q4 2023 (75 deals) and remained on par with that of Q1 2023 (104 deals).

- With three $1 billion+ M&A deals announced in the sector during Q1 2024, M&A volume totaled $13.8 billion, an increase of more than 20x over Q1 2023 ($657 million) and 4x over Q4 2023 ($3.3 billion).

- The Crypto & Blockchain sector reached a new record for quarterly financing deal count, with 300 capital raises in Q1 2024, representing a 36% year-over-year increase.

- While the number of crypto investments peaked, volume remained consistent with the last four quarters totaling $1.6 billion.

- As the crypto winter thawed, the price of bitcoin rose 69% during Q1 2024 reaching a new all-time-high in March. The increase came alongside the news of the SEC’s approval of US-listed spot bitcoin ETFs, a watershed moment for the industry, and a renewed interest in crypto from consumers.

Report Features:

- Q1 2024 and historical Crypto & Blockchain and Wealth & Capital Markets Tech financing and M&A volume and deal count statistics

- Largest financings and M&A transactions in Q1 2024

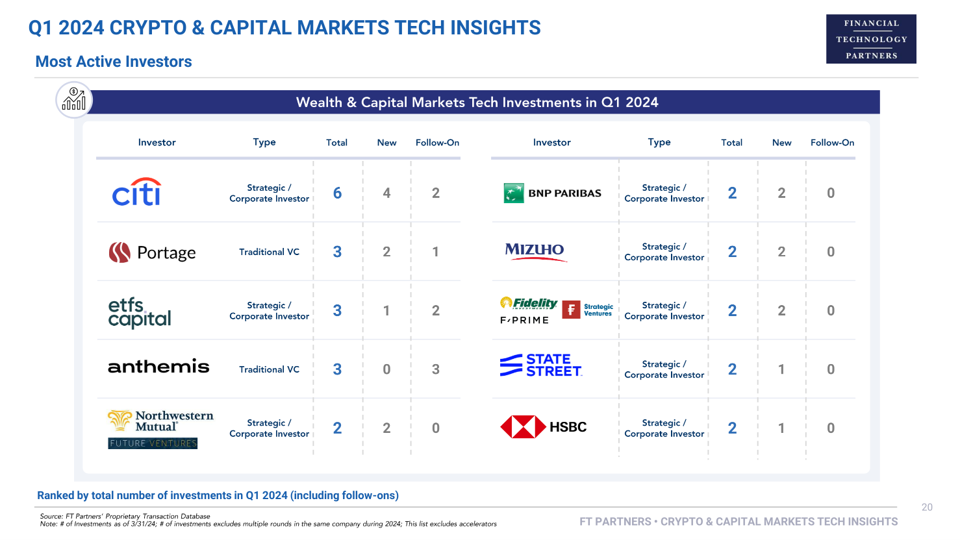

- Most active investors across both sectors

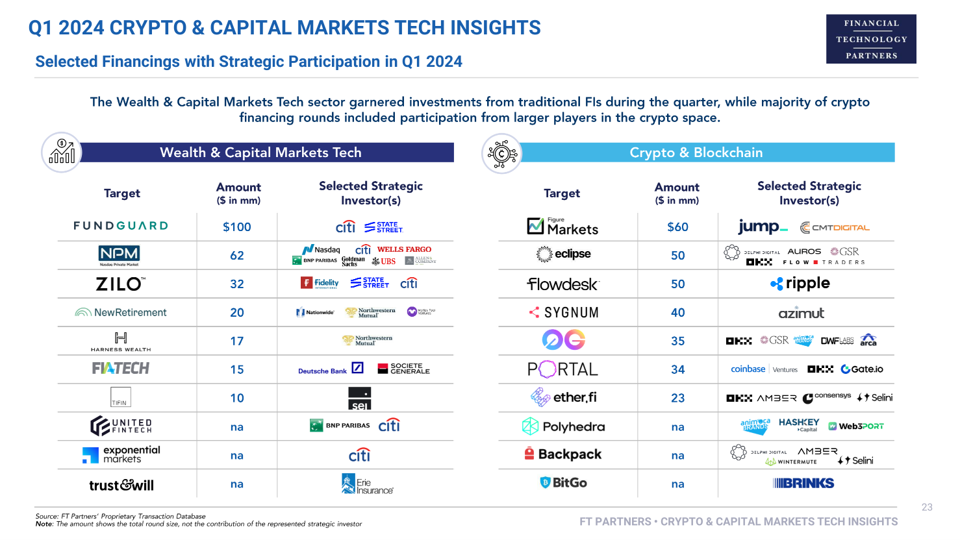

- Corporate VC activity and strategic investor participation

- Market performance data, IPO and SPAC volumes, and crypto prices and volumes

View Prior Reports