FT Partners Quarterly Payments Insights and Annual Almanac

FT Partners is the only data source for comprehensive, global Payments deal activity covering M&A, Financing and IPO statistics and trends

FT Partners’ Payments Insights Reports are published on a quarterly basis, along with a comprehensive year-end Almanac. All information included in the reports is sourced from FT Partners’ Proprietary Transaction Database, which is compiled by the FT Partners Research Team through primary research and data analysis. The reports feature M&A, financing and IPO statistics and trends as well as breakdowns by vertical, geography, investor-type and much more.

View our Global FinTech Insights and Almanac reports here.

Be sure to check back for quarterly updates and additions. All recent reports can be viewed or downloaded for free below.

Q3 2022 Payments Insights

Report Features:

- Q3 2022 and historical Payments sector financing and M&A volume and deal count statistics

- Largest Payments sector financings and M&A transactions in Q3 2022

- Breakdowns by geography

- Most active investors in the Payments sector and strategic investor participation

- Other industry, capital raising and M&A trends in the Payments sector

Key Highlights:

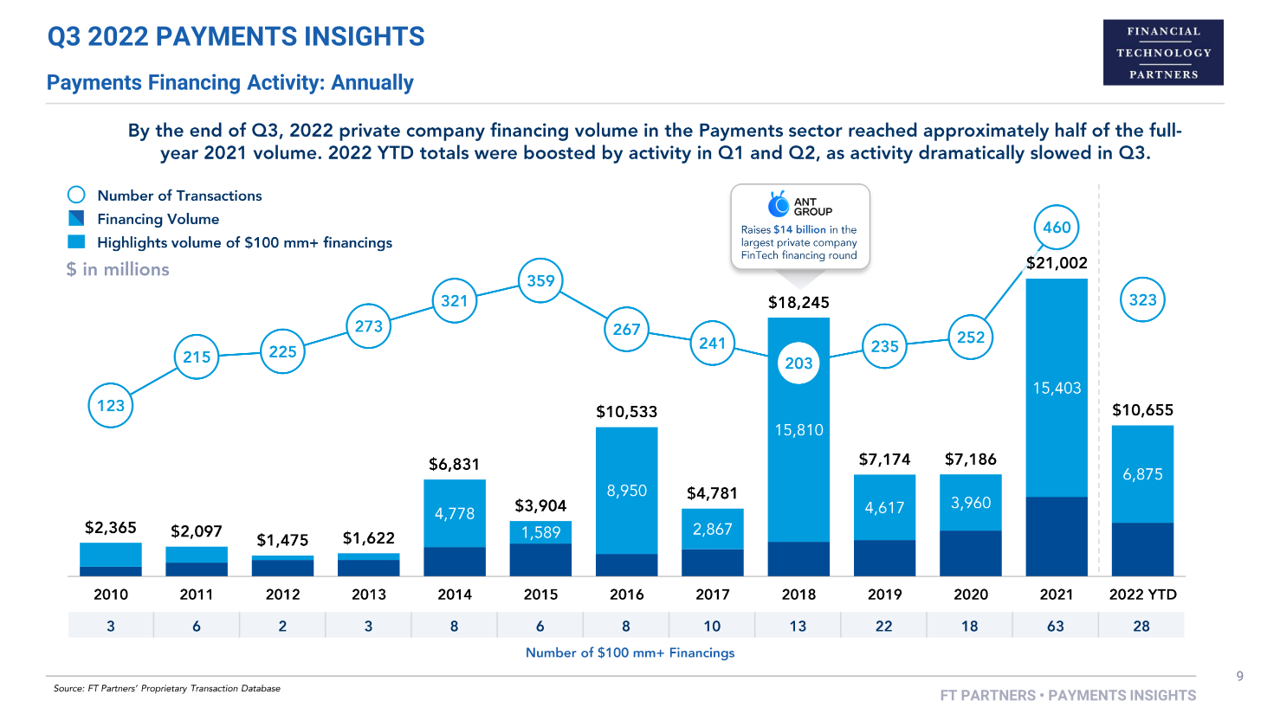

- Private company fundraising activity in the Payments space sharply declined in Q3 2022 alongside the rest of the FinTech sector. From Q2 2022, financing volume dropped 59% to $1.8 billion and deal count decreased by 24% to 79 capital raises.

- There were only three $100 million+ financing rounds in Q3 2022, compared with 14 in Q2 2022.

- The US has been the most active country so far this year, with 101 financing deals, followed by the UK (38), India (21), Singapore (13) and Nigeria (10) – the last three represent major emerging FinTech markets, particularly for innovation around Payments.

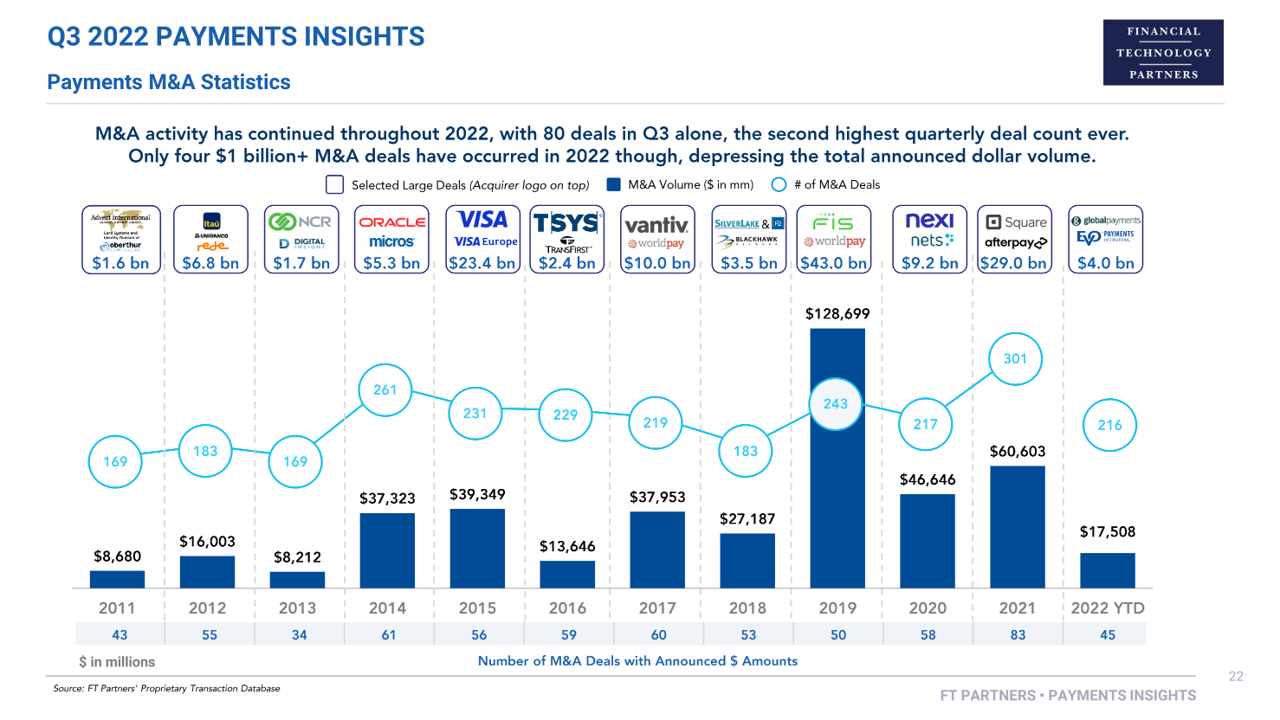

- At the end of the third quarter, the majority of M&A deals announced in 2022 were relatively small, with 58% of transactions with announced dollar amounts valued at $100 million or less. Only four deals exceeded have $1 billion in value thus far, depressing the total announced M&A dollar volume relative to prior years.