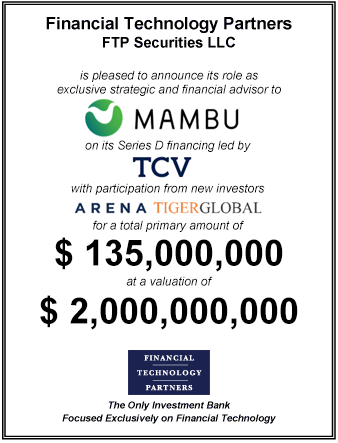

FT Partners Advises Mambu on its $135 million Series D Financing

Overview of Transaction

- On January 7, 2021, Mambu announced it has raised $135 million of new capital in its Series D financing at a valuation of ~$2 billion. The investment is led by TCV with participation from existing investors, including Acton Capital Partners, Bessemer Venture Partners, Runa Capital, as well as new investors Arena Holding and Tiger Global

- Mambu is a SaaS cloud banking platform empowering its customers to easily and flexibly build and expand their banking products. Mambu is the originator of the composable banking approach, which prioritizes rapid, flexible assembly of independent, best-for-purpose systems

- Since launching in May 2011, Mambu has grown its client portfolio to more than 160 banks, FinTech providers, and corporates across more than 50 countries

Significance of Transaction

- The transaction values Mambu at ~$2 billion, underscoring the company’s leadership position in redefining the global core banking technology market

- With this new round of financing, Mambu will continue to accelerate its rapid growth by deepening its footprint in the more than 50 countries in which it already operates and continuing to expand both the breadth and depth of its platform

FT Partners' Role

- FT Partners served as exclusive financial and strategic advisor to Mambu

- This transaction highlights FT Partners’ deep domain expertise in a broad range of Banking Tech companies, as well as its successful track record generating highly favorable outcomes for high-growth, unicorn FinTech companies globally