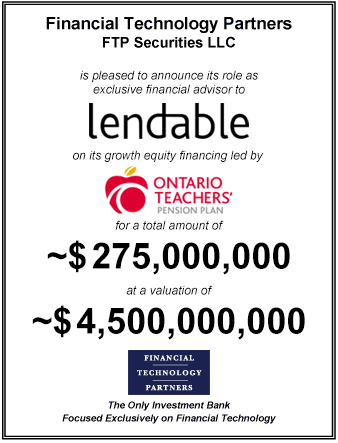

FT Partners Advises Lendable on its ~$275,000,000 Financing

Overview of Transaction

- Lendable has raised £210 million (~$275 million) of new capital led by Ontario Teachers' Pension Plan in its latest growth equity financing round

- Co-founded in 2014 by Martin Kissinger and Victoria van Lennep, Lendable is an AI-led consumer finance platform, headquartered in the UK, offering a seamless and transparent multi-product experience

- The company’s technology platform connects global institutional investors with borrowers across loans, credit cards and car finance

- The company applies machine learning and automation to data sets leading to better rates, transparency, underwriting and ultimately customer service

- Lendable also plans to widen its offering to include new products such as BNPL as well as expand in the US

- The addressable consumer credit market across the UK and the US is estimated at ~$3 trillion

- Lendable has been profitable since 2017

Significance of Transaction

- Lendable has an unparalleled profile through its unique combination of growth, scale and profitability; the transaction will further accelerate Lendable’s growth, expand its product offering, and support its upcoming launch in the US

- Ontario Teachers' Pension Plan is one of the world’s largest institutional investors, and the investment, via Teachers’ Innovation Platform, represents its continued commitment to supporting cutting-edge private tech companies led by mission-driven entrepreneurs to help fulfil their vision and shape better futures

FT Partners' Role

- FT Partners serves as exclusive financial advisor to Lendable

- The transaction highlights FT Partners’ industry-leading expertise and successful track record within lending and the broader consumer finance sector