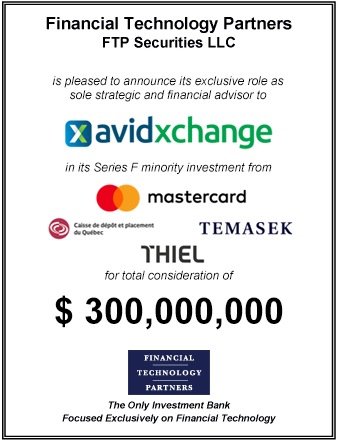

FT Partners Advises AvidXchange on its $300,000,000 Financing

Overview of Transaction

- On June 8, 2017, AvidXchange announced a minority $300mm Series F financing round

- Mastercard, CDPQ and Temasek co-led the equity round with participation from Peter Thiel

- In addition to the equity investment, AvidXchange also announced a strategic partnership with Mastercard to deliver accounts payable and payment automation to midsize businesses; the offering will be marketed as The Mastercard B2B Hub powered by AvidXchange

- AvidXchange is a best-in-class business-to-business payments company that is revolutionizing how companies pay their bills by automating the invoice and payment processes

- The Company focuses on serving mid-market clients and spans multiple industries including Real Estate, Financial Services, Energy and Construction

Significance of Transaction

- The transaction will further help AvidXchange expand as the leading independent business-to-business invoice and payment solution provider

- Strategic relationship with Mastercard expected to fuel additional growth in driving forward Avid's existing bank channel

- Firmly positions the Company to continue to grow the core business, invest in infrastructure and product development and pursue opportunistic acquisitions

FT Partners' Role

- FT Partners served as exclusive strategic and financial advisor to AvidXchange and its Board of Directors

- FT Partners leveraged its deep knowledge, extensive experience and broad industry relationships to help achieve a highly favorable outcome for the Company

- Transaction demonstrates FT Partners' continued success advising $100mm+ financings