News

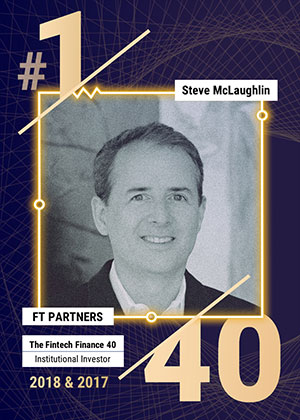

FT Partners' Steve McLaughlin Ranked #1 for Second Year in a Row on Institutional Investors' Annual Ranking

The FinTech Finance 40: Steve McLaughlin – Rank: #1

Managing Partner and Chief Executive Officer, Financial Technology Partners

November 13, 2018 – by Jeffrey Kutler

Steve McLaughlin

Currently ranked: 1

Previously ranked: 1

If humanly possible, Steve McLaughlin would be everywhere at once in the FinTech world. Because it isn’t, McLaughlin built Financial Technology Partners — the boutique investment bank he founded in San Francisco in 2002 — into a deal-making juggernaut. It has grown to 120 people, opened offices in New York and London, and globally does about 40 transactions a year. Size and scope matter to the 49-year-old managing partner and CEO, who prides himself on understanding the market from the ground up, identifying and forming relationships with early-stage entrepreneurs, and guiding them up the financing ladder to IPOs. “Being one group, around the world, in all sectors,” as McLaughlin puts it, contrasts with the more focused teams within, say, Goldman Sachs, where he spent seven years. “We are working with unicorns on all continents,” he boasts, referring to companies with $1 billion valuations and presumably overlooking Antarctica. These unicorns include Singapore-based ride-hailing company Grab Holdings and its GrabPay program, and Brazilian transaction processor Stone Pagamentos.

In May the $1 billion IPO of GreenSky valued the Atlanta point-of-sale payment and credit company at $4.5 billion. This deal exemplified what McLaughlin calls “the unique, repeat nature of our client relationships.” Before serving as the firm’s IPO adviser, FT Partners advised GreenSky on a $300 million private financing round in 2014, a loan-purchase agreement with Fifth Third Bank in 2016, and a $200 million investment by Pimco in 2017. “The unprecedented pace of investments that we are seeing foretells years and years of FinTech growth,” McLaughlin says.