Commodities FinTech: How Technology is Reshaping Risk, Revenue and P&L Management for Commodity Producers

Executive Summary:

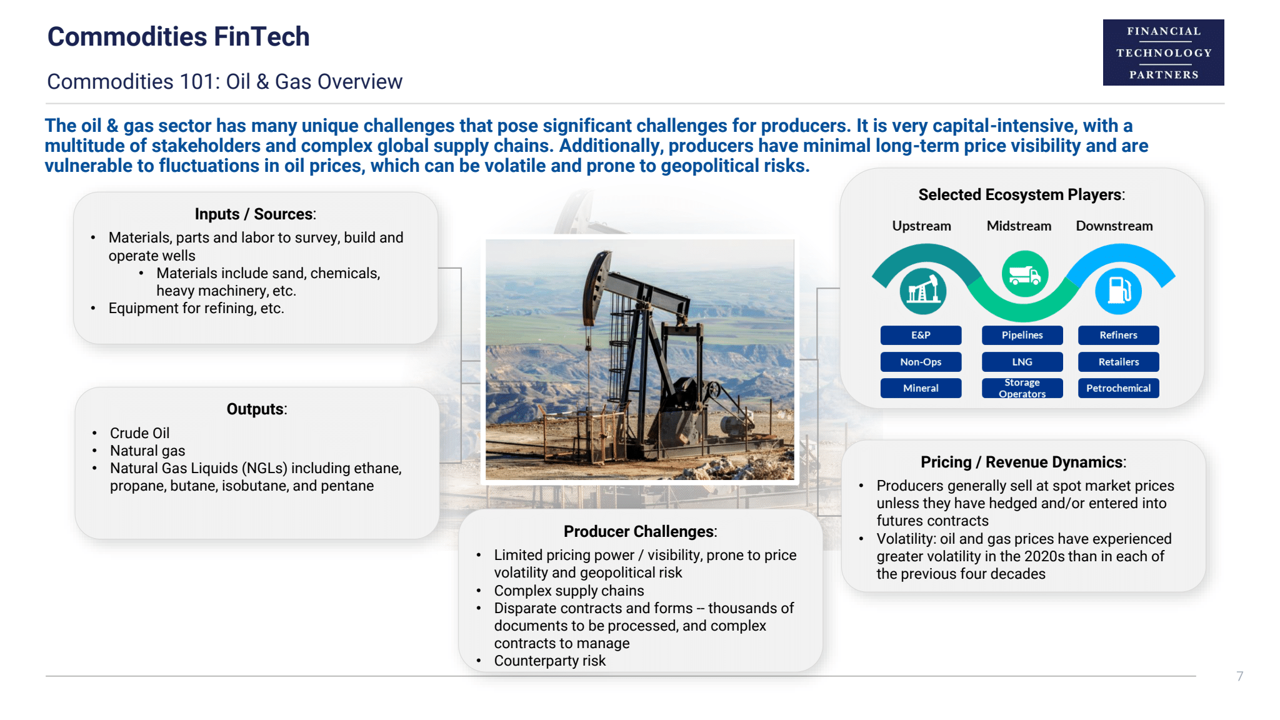

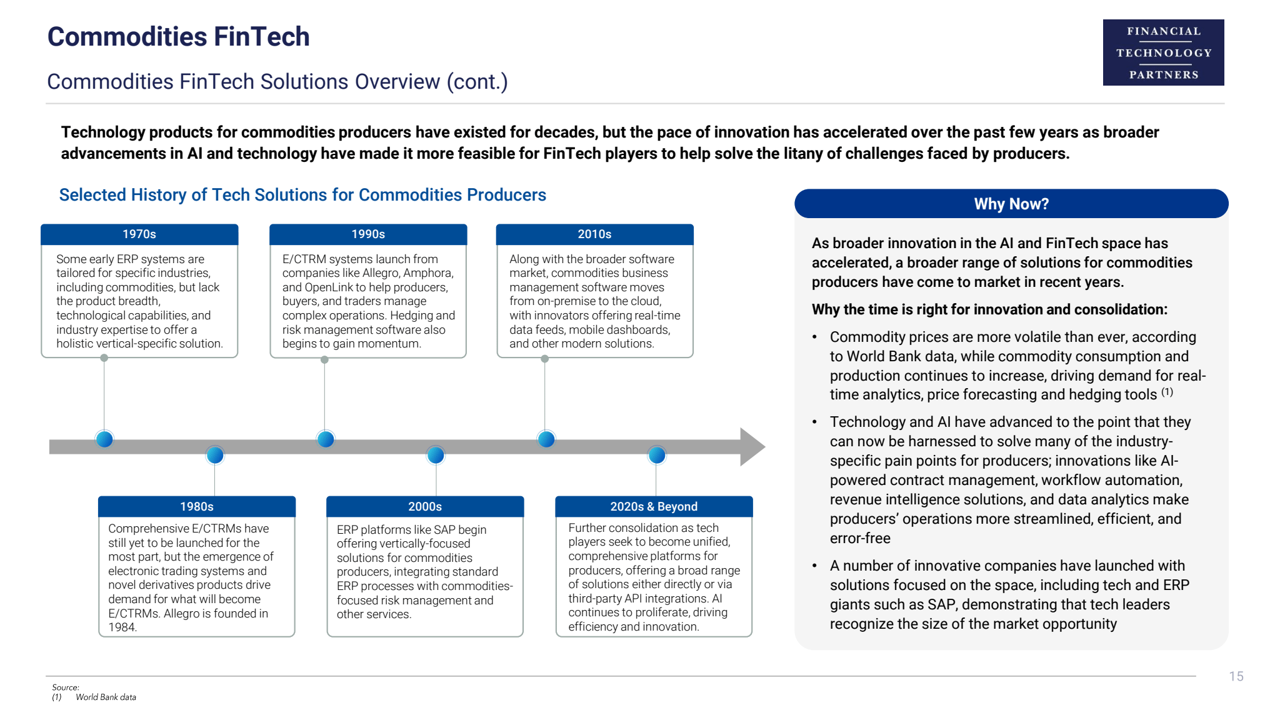

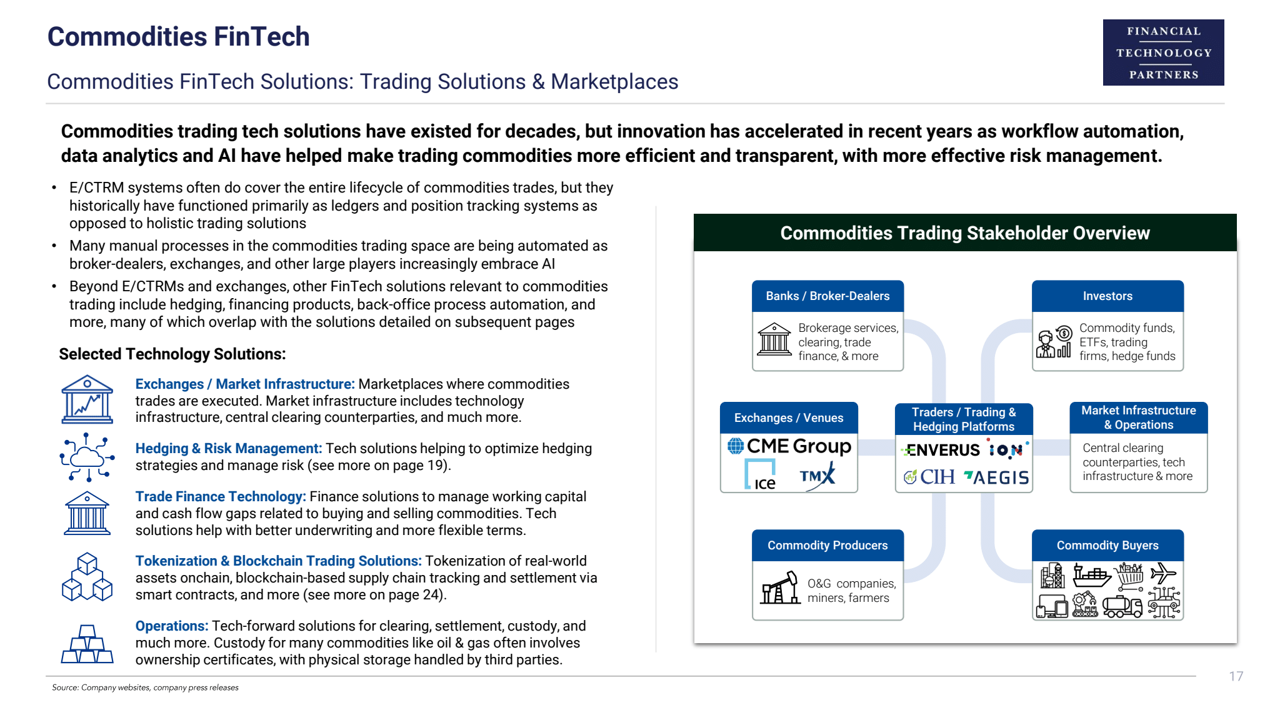

Commodities producers face many industry-specific challenges, including: manual and archaic processes; a wide variety of outputs and related contracts; large, unstructured datasets; and unique pricing dynamics whereby pricing power is minimal, making revenue streams potentially highly volatile. This presents a major opportunity for FinTech and technology solutions to automate workflows and improve risk management, long-term visibility and forecasting, and overall efficiency. A number of vertical-specific solutions have emerged in recent years, aiming to streamline Office of the CFO functions specifically tailored for commodities producers. The space has attracted recent attention following Blackstone's $6 billion+ acquisition of commodities software and data provider Enverus, as well as Tokio Marine's ~$1 billion acquisition of Commodity & Ingredient Hedging. Investors and strategics are clearly recognizing the market opportunity for innovative, tech-forward solutions.

Key discussion topics of the report include:

- A discussion of the vertical-specific challenges faced by commodities producers, particularly on the more volatile revenue side of the P&L

- An overview of the various FinTech solutions that have emerged to help solve these issues across the commodities sector globally

- Profiles of 20+ leading FinTech companies serving commodity producers and the broader commodity value chain

- Exclusive interviews with the CEOs of leading companies in the space