FT Partners Quarterly InsurTech Insights and Annual Almanac

FT Partners is the only data source for comprehensive, global InsurTech deal activity covering M&A, Financing and IPO statistics and trends

FT Partners’ InsurTech Insights Reports are published on a quarterly basis, along with a comprehensive year-end Almanac. All information included in the reports is sourced from FT Partners’ Proprietary Transaction Database, which is compiled by the FT Partners Research Team through primary research and data analysis. The reports feature M&A, financing and IPO statistics and trends as well as breakdowns by vertical, geography, investor-type and much more.

View our Global FinTech Insights and Almanac reports here.

Be sure to check back for quarterly updates and additions. All recent reports can be viewed or downloaded for free below.

2023 InsurTech Almanac

Report Features:

- 2023 and historical InsurTech financing and M&A volume and deal count statistics

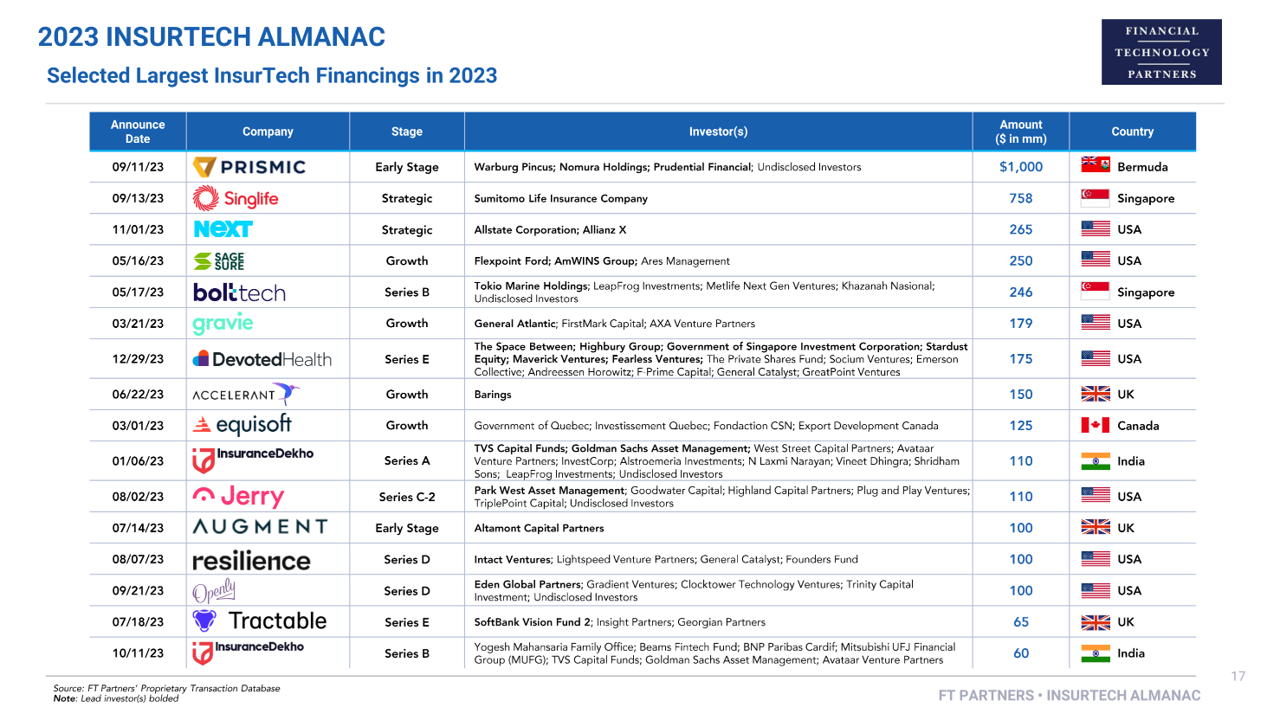

- Largest InsurTech financings and M&A transactions in 2023

- Most active InsurTech investors

- Breakdowns by geography, product type and business model

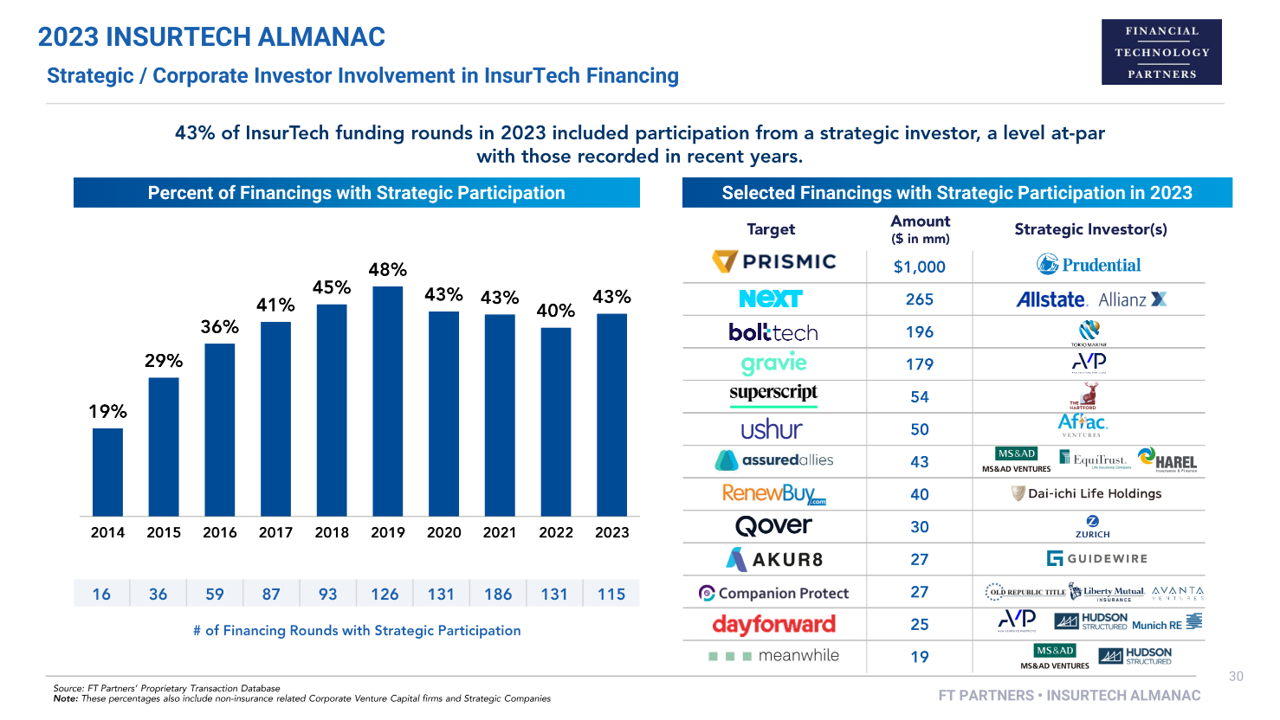

- Corporate VC activity and strategic investor participation

- Other industry, capital raising and M&A trends in InsurTech

Key Highlights:

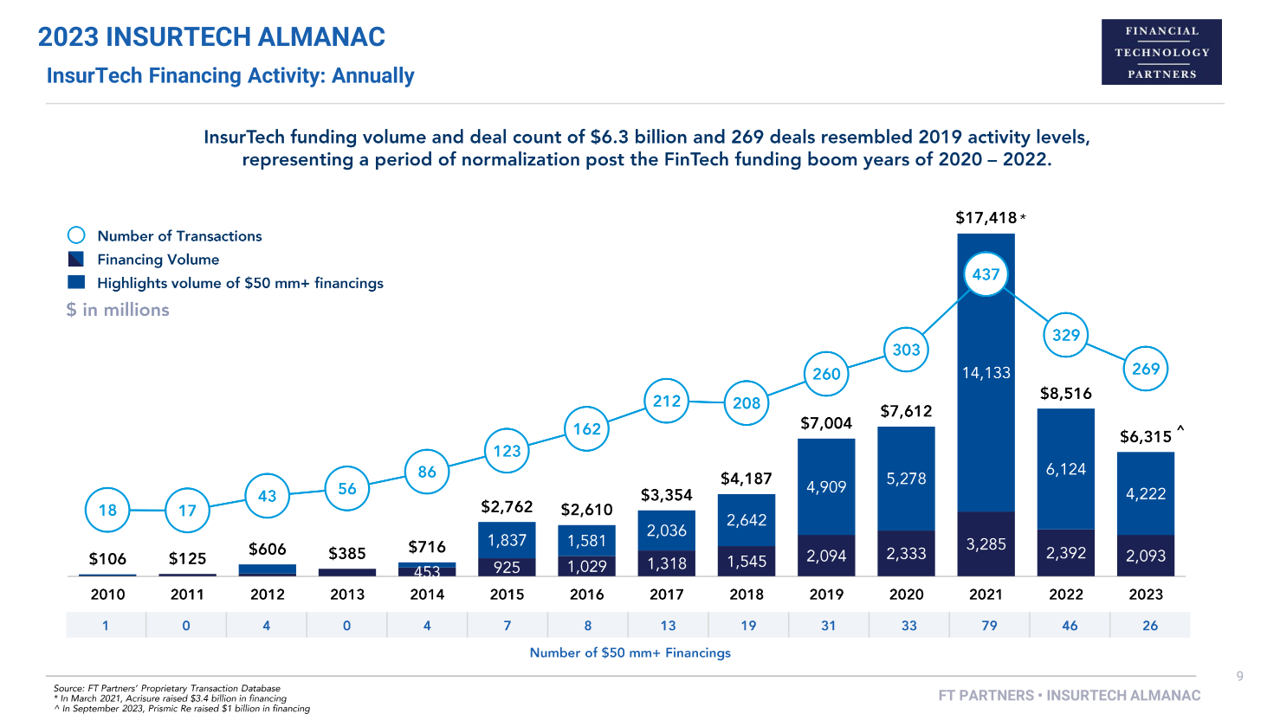

- Private InsurTech company financing activity went through a period of normalization in 2023, dropping back to pre-”funding boom year” levels, mirroring the broader FinTech market reset.

- Specifically, 2023 InsurTech funding volume of $6.3 billion represented a decline of 64% from the peak of activity in 2021 ($17.4 billion) and 26% from 2022 ($8.5 billion), reaching a level much closer to that of 2019 ($7.0 billion).

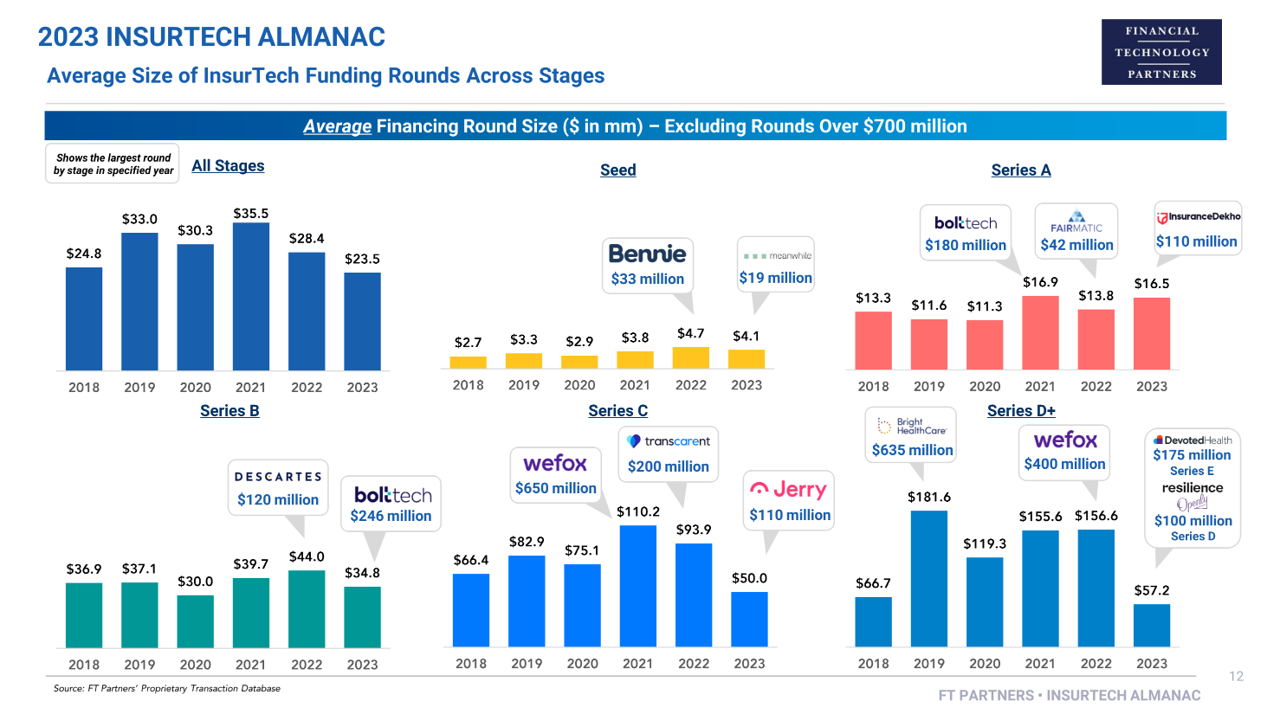

- For the first time since 2018, two times more capital was invested in Seed through Series B rounds compared to Series C and later venture stages.

- Bolttech’s $246 million Series B round and InsuranceDekho’s $110 million Series A round both boosted early-stage volume during the year and represented the largest InsurTech Series A and Series B round ever, respectively.

- While fundraising levels fell, M&A volume in 2023 increased 3x year-over-year reaching $18.5 billion, driven by six $1 billion+ deals. The largest deal during the year was Sumitomo’s majority acquisition of Singlife valued at $3.4 billion, followed by Virgin Pulse’s $3 billion merger with benefits platform HealthComp and Vista Equity Partners’ $2.6 billion take private acquisition of Duck Creek.

View Prior Reports